Rakibul Hasan, the CEO and founder of Autosdonation, is an automotive specialist with over a decade of industry experience. With a distinct mastery in car...Read more

As a parent, you may be considering gifting your car to your son in Vermont. While this is a thoughtful gesture, it’s important to understand the legal and financial implications of such a gift. In this article, we’ll explore the process of gifting a car in Vermont and what you need to know before making this decision. From understanding tax implications to navigating insurance requirements, we’ll cover everything you need to know to make an informed decision about gifting a car to your son in Vermont.

Can I Gift a Car to My Son in Vermont?

If you’re a parent, you may be wondering if you can gift a car to your son in Vermont. The answer is yes, but there are some important things to consider before doing so.

Rules and Regulations for Gifting a Car

Before gifting a car to your son in Vermont, it’s important to understand the rules and regulations surrounding the process. The first step is to make sure that the car is paid off and that you have the title in your name. Once you have the title, you can transfer it to your son by filling out the necessary paperwork at the Department of Motor Vehicles (DMV).

It’s important to note that Vermont has strict emissions standards, and the car must pass an emissions test before it can be registered. If the car fails the test, it must be repaired before it can be registered. Additionally, you will need to provide proof of insurance before the car can be registered.

Benefits of Gifting a Car

Gifting a car to your son can be a great way to help him get started on the road to independence. It can also save him money on transportation costs, which can be significant, especially if he lives far from his job or school. Additionally, gifting a car can be a great way to show your son that you trust him and believe in his ability to be responsible.

Things to Consider Before Gifting a Car

While gifting a car can be a great way to help your son, there are some important things to consider before doing so. For example, if your son is a new driver, he may not have the experience necessary to handle a larger or more powerful car. Additionally, if your son has a poor driving record or has been involved in accidents in the past, gifting a car may not be the best idea.

Another thing to consider is the cost of maintenance and repairs. While you may be gifting the car to your son, he will be responsible for the ongoing maintenance and repairs. If he doesn’t have the financial resources to do so, he may end up with a car that is unreliable or unsafe.

Gifting a Car vs. Selling a Car

When deciding whether to gift a car or sell it to your son, there are some important things to consider. If you sell the car to your son, you will receive payment for it, which can be helpful if you need the money. However, if you gift the car, you won’t receive any money, but you will be helping your son financially.

Another thing to consider is the tax implications of gifting a car. If you gift a car to your son, you may be subject to gift tax. However, there are some exemptions that may apply, depending on the value of the car and the relationship between you and your son.

Conclusion

In conclusion, gifting a car to your son in Vermont can be a great way to help him get started on the road to independence. However, it’s important to understand the rules and regulations surrounding the process, as well as the benefits and potential drawbacks. By taking the time to consider these factors, you can make an informed decision that is right for you and your son.

Contents

Frequently Asked Questions

Can I Gift a Car to My Son in Vermont?

Yes, you can gift a car to your son in Vermont. However, you will need to follow the legal process to transfer the ownership of the vehicle. The process involves completing the necessary paperwork and paying the required fees.

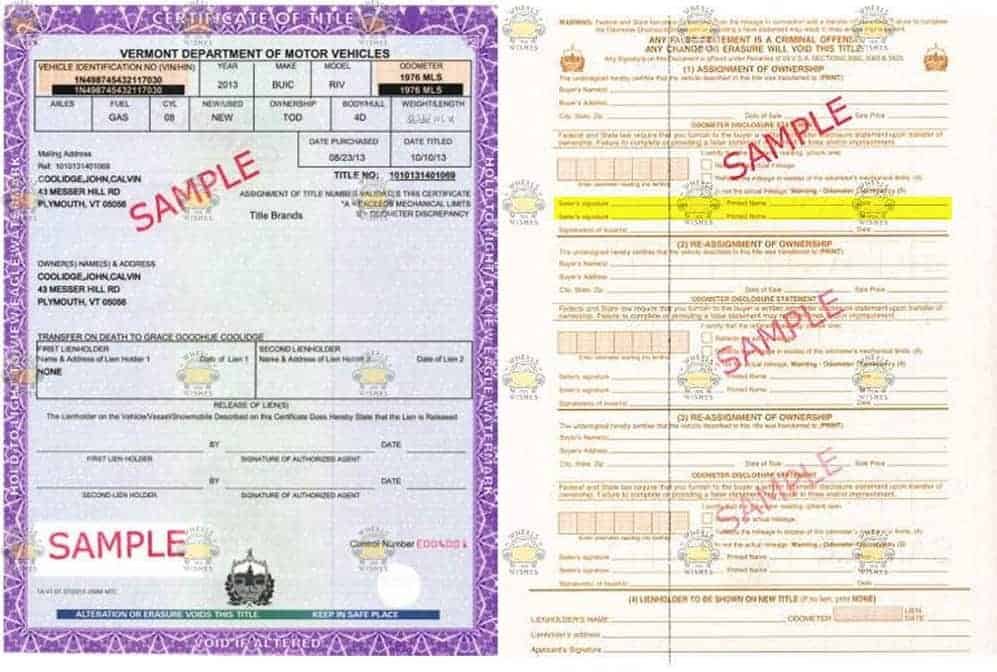

To transfer the ownership of the car, you will need to provide the Certificate of Title, a Bill of Sale, and the Gift Tax Form to the Vermont DMV. Additionally, your son will need to provide proof of insurance and pay the registration fees.

Do I Have to Pay Taxes on the Gift?

Yes, you may have to pay taxes on the gift of the car depending on its value. Vermont has a gift tax law that applies to any gift, including vehicles, that exceeds $15,000 in value. The tax rate is based on the fair market value of the vehicle at the time of the gift.

You will need to complete the Gift Tax Form and pay the applicable taxes to the Vermont Department of Taxes. It is recommended to consult with a tax professional to determine if you are required to pay taxes on the gift of the car.

What Happens if the Car Has a Lien?

If the car has a lien, you will need to satisfy the lien before transferring the ownership of the vehicle. The lienholder must release the lien by signing the Certificate of Title. You will also need to provide a lien release document and pay any fees associated with the lien release.

If you are unable to satisfy the lien, you may not be able to transfer the ownership of the car. It is recommended to consult with the lienholder and the Vermont DMV to determine the best course of action.

Can I Gift a Car to My Son Who Lives Out of State?

Yes, you can gift a car to your son who lives out of state. However, the process may vary depending on the state where your son resides. You will need to follow the legal process in both Vermont and the state where your son lives to transfer the ownership of the car.

You may need to provide additional documents and pay additional fees to transfer the ownership of the car across state lines. It is recommended to consult with the DMV in both Vermont and the state where your son resides to determine the necessary steps.

What Happens if I Don’t Transfer the Ownership of the Car?

If you don’t transfer the ownership of the car, you may be held liable for any accidents or incidents involving the vehicle. Additionally, if your son receives a traffic citation or is involved in an accident, you may be held responsible as the legal owner of the vehicle.

It is important to complete the transfer of ownership to protect yourself and your son from any legal or financial consequences. You should also inform your insurance company of the transfer to ensure that your son is covered under your policy or has his own insurance.

How To Gift A Vehicle To Someone Without Paying Taxes

In conclusion, gifting a car to your son in Vermont is possible and can be a great way to show your love and support for them. However, there are some legal requirements that you must fulfill to ensure a smooth transfer of ownership.

Firstly, you must provide a bill of sale and fill out the necessary paperwork with the Vermont Department of Motor Vehicles. Secondly, your son will need to register the car in their name and obtain insurance coverage.

Overall, while the process of gifting a car may seem daunting, with the right preparation and attention to detail, it can be a rewarding experience for both you and your son. So, if you are considering gifting a car to your son in Vermont, make sure to follow the legal requirements and enjoy the joy of giving.

Rakibul Hasan, the CEO and founder of Autosdonation, is an automotive specialist with over a decade of industry experience. With a distinct mastery in car donations, sponsorships, and gifting, Rakibul combines his passion for automobiles and generosity to revolutionize the car donation landscape. He established Autosdonation to facilitate the car donation and gifting process, making it more accessible and enjoyable for all involved.

More Posts