Rakibul Hasan, the CEO and founder of Autosdonation, is an automotive specialist with over a decade of industry experience. With a distinct mastery in car...Read more

Are you looking to gift a car to a loved one in Texas? While it might seem like a generous gesture, you might be surprised to learn that there are tax implications to consider. Whether you’re the giver or the receiver, it’s important to understand the rules and regulations surrounding gifting a car in Texas to avoid any unexpected fees or penalties. In this article, we’ll explore the ins and outs of gifting a car in Texas and provide you with the information you need to make an informed decision.

Contents

- Can You Gift a Car in Texas Without Paying Taxes?

- Frequently Asked Questions

- Can You Gift a Car in Texas Without Paying Taxes?

- What Happens If You Don’t Fill Out the Necessary Paperwork?

- Can You Gift a Car to a Non-Family Member?

- What is the Gift Tax Exemption in Texas?

- What Other Taxes Do You Have to Pay When Gifting a Car?

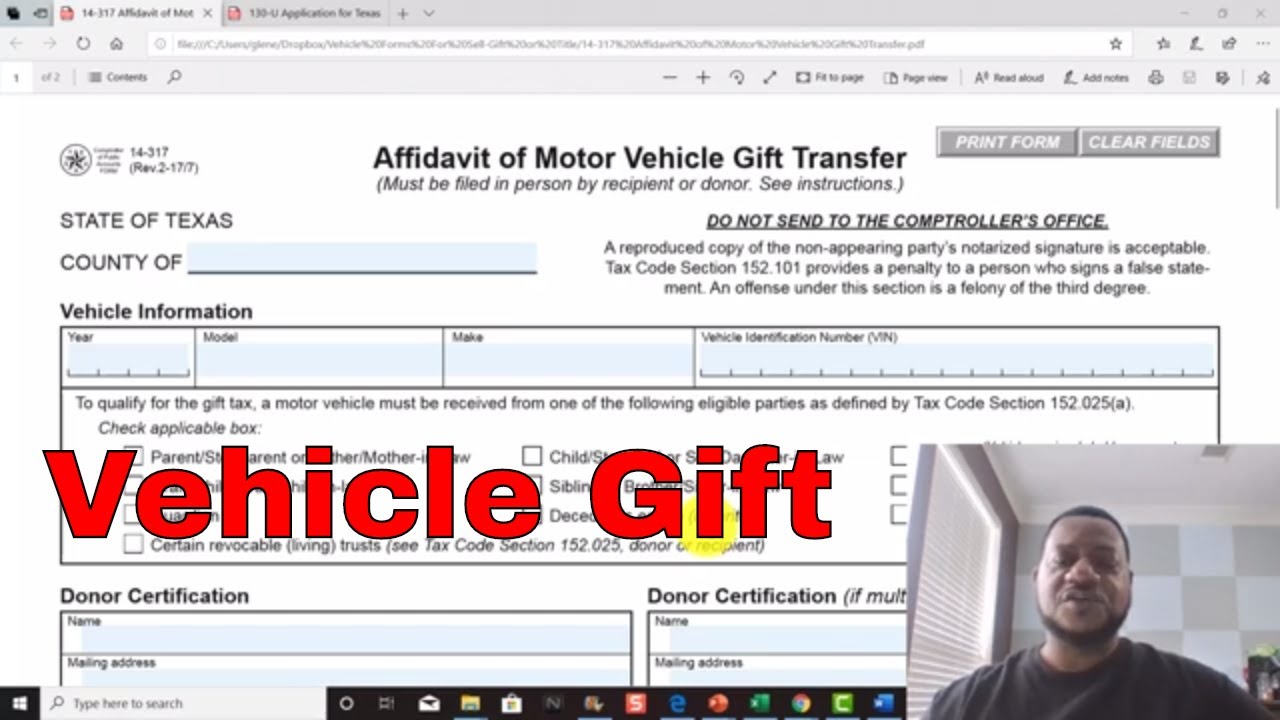

- Gift a vehicle without paying sales tax – Gift Tax $10 – Form 14-317 – Save Tax Money

Can You Gift a Car in Texas Without Paying Taxes?

The thought of gifting a car to a friend or loved one is a kind gesture, but it can also come with certain tax implications. For Texas residents, it’s important to understand the rules and regulations surrounding car gifting to ensure that you don’t end up with unexpected tax bills. In this article, we’ll explore the topic of gifting a car in Texas and whether or not you’ll need to pay taxes on it.

What Does Texas Law Say About Gifting Cars?

According to the Texas Department of Motor Vehicles (DMV), you can gift a car to anyone you like, as long as they meet certain criteria. To qualify for a tax-free car gift, the recipient must be a family member, defined as a spouse, parent, child, grandparent, grandchild, sibling, or legal guardian. If the recipient doesn’t fall into one of these categories, you’ll need to pay taxes on the car’s value.

It’s also worth noting that the DMV requires you to provide a gift affidavit when transferring ownership of the vehicle. This document confirms that the transfer is a gift and not a sale, and must be signed by both the donor and recipient. Failure to provide a gift affidavit could result in penalties and fines.

How Much Tax Do You Have to Pay on a Gifted Car?

If you’re gifting a car to someone who doesn’t meet the family member criteria, you’ll need to pay taxes based on the car’s fair market value. This can be a significant amount, as the tax rate in Texas is 6.25% of the sales price or 80% of the car’s value, whichever is higher. For example, if you gift a car valued at $20,000 to a friend, you’ll need to pay $1,250 in taxes.

However, if you’re gifting a car to a family member, you won’t need to pay any taxes. This is because Texas law allows for tax-free transfers between family members, as long as the gift affidavit is provided.

The Benefits of Gifting a Car

Gifting a car can be a great way to help out a family member or friend in need. It can also be a useful way to get rid of a car that you no longer need or want, without having to go through the hassle of selling it. In addition, gifting a car can create a strong bond between the giver and recipient, and can be a meaningful way to show your love and appreciation.

Another benefit of gifting a car is that it can be a tax-efficient way to transfer assets to your heirs. Instead of leaving a car as part of your estate, which could be subject to estate taxes, you can give it away as a gift while you’re still alive. This can help to reduce your taxable estate and ensure that your assets go to the people you care about most.

Gifting a Car Vs Selling a Car

When deciding whether to gift a car or sell it, there are several factors to consider. If you’re in a financial position to do so, gifting a car can be a generous and meaningful gesture that can strengthen your relationships with loved ones. On the other hand, if you need the money from the sale of the car to cover expenses, selling it may be the better option.

Another factor to consider is the tax implications. As we’ve seen, gifting a car can be tax-free or subject to taxes, depending on the circumstances. Selling a car will typically result in capital gains taxes, but you may be able to offset some of these taxes with deductions or credits.

Conclusion

In conclusion, gifting a car in Texas can be a tax-free or taxable transaction, depending on whether or not the recipient is a family member. If you’re considering gifting a car, it’s important to understand the rules and regulations surrounding the process to avoid unexpected tax bills or penalties. By providing a gift affidavit and following the proper procedures, you can ensure a smooth and hassle-free transfer of ownership.

| Gifting a Car to a Family Member | Gifting a Car to a Non-Family Member |

|---|---|

| No taxes | Taxes based on car’s fair market value |

| Gift affidavit required | Gift affidavit required |

| Can be a tax-efficient way to transfer assets | May be subject to capital gains taxes |

Frequently Asked Questions

Can You Gift a Car in Texas Without Paying Taxes?

Yes, you can gift a car in Texas without paying taxes, but there are some conditions that you need to meet. The first condition is that the recipient must be an immediate family member. This includes spouses, parents, children, siblings, and grandparents. If the recipient is not an immediate family member, then they will have to pay the standard sales tax rate.

The second condition is that you must fill out the necessary paperwork correctly. You will need to complete a gift affidavit, which is a legal document that states the vehicle is a gift and not a sale. You will also need to provide proof of insurance and a valid driver’s license. Once you have completed the necessary paperwork, you can transfer the vehicle to the recipient without paying any taxes.

What Happens If You Don’t Fill Out the Necessary Paperwork?

If you don’t fill out the necessary paperwork correctly, then you may be liable for paying the sales tax. This is because the state of Texas assumes that any transfer of a vehicle is a sale unless there is proof that it is a gift. If you cannot prove that the vehicle is a gift, then you will have to pay the standard sales tax rate.

Additionally, if you don’t fill out the necessary paperwork, then you may be held liable for any damages or accidents that occur with the vehicle. This is because the vehicle will still be registered in your name, and you will still be considered the legal owner until the transfer is complete.

Can You Gift a Car to a Non-Family Member?

Yes, you can gift a car to a non-family member, but you will have to pay the standard sales tax rate. This means that you will have to pay 6.25% of the vehicle’s value in sales tax. If you want to avoid paying this tax, then you will have to gift the car to an immediate family member.

However, even if you gift the car to a non-family member, you can still fill out the necessary paperwork to transfer the vehicle’s title to the recipient. This will ensure that the vehicle is registered in the recipient’s name and that you are no longer responsible for any damages or accidents that occur with the vehicle.

What is the Gift Tax Exemption in Texas?

In Texas, there is no gift tax, which means that you do not have to pay any taxes on gifts that you give to others. This includes gifts of property, such as cars, and gifts of money. However, if you give a gift to someone who is not an immediate family member, then they may have to pay taxes on the gift when they file their income tax return.

It’s important to note that the federal government does have a gift tax, but it only applies if you give more than $15,000 in gifts to a single person in a single year. If you give less than $15,000, then you do not have to pay any federal gift tax.

What Other Taxes Do You Have to Pay When Gifting a Car?

In addition to the sales tax, there are other taxes that you may have to pay when gifting a car in Texas. For example, you may have to pay a gift tax if you give a car to someone who is not an immediate family member. You may also have to pay a use tax if the recipient registers the vehicle in a different state.

It’s important to consult with a tax professional to determine what taxes you may have to pay when gifting a car. They can help you understand the tax laws in Texas and ensure that you are in compliance with all state and federal tax regulations.

Gift a vehicle without paying sales tax – Gift Tax $10 – Form 14-317 – Save Tax Money

In conclusion, gifting a car in Texas may seem like a straightforward process, but it’s important to understand the tax implications that come with it. While you may not have to pay sales tax on the gift itself, if the car has not been registered in Texas before, you may still be subject to other fees and taxes. It’s important to consult with a tax professional or the Texas Department of Motor Vehicles to ensure you’re following all the necessary steps and avoiding any surprise tax bills.

However, if you do gift a car in Texas and follow all the necessary procedures, it can be a generous and thoughtful gesture. It’s important to ensure that the recipient is responsible and capable of taking on the responsibility of car ownership. With careful planning and consideration, gifting a car in Texas can be a wonderful way to show someone you care.

Overall, gifting a car in Texas can be a great option for those looking to help out a friend or family member in need. Just be sure to do your research and follow all the necessary steps to avoid any unwanted tax surprises. With a little bit of effort, you can give the gift of a car without breaking the bank.

Rakibul Hasan, the CEO and founder of Autosdonation, is an automotive specialist with over a decade of industry experience. With a distinct mastery in car donations, sponsorships, and gifting, Rakibul combines his passion for automobiles and generosity to revolutionize the car donation landscape. He established Autosdonation to facilitate the car donation and gifting process, making it more accessible and enjoyable for all involved.

More Posts