Rakibul Hasan, the CEO and founder of Autosdonation, is an automotive specialist with over a decade of industry experience. With a distinct mastery in car...Read more

Are you looking to gift a car to a family member or friend in Louisiana? It’s important to understand the legal requirements and process involved in this transaction. In this article, we’ll discuss the rules and regulations surrounding gifting a car in Louisiana, so you can navigate the process with ease and ensure a smooth transaction.

Can You Gift a Car in Louisiana?

Are you thinking of giving a car to a family member or a friend in Louisiana? If so, you may be wondering whether it’s legal to do so and what the process involves. In Louisiana, you can gift a car to someone, but there are certain requirements that you need to meet. Read on to find out more.

What You Need to Know About Gifting a Car in Louisiana

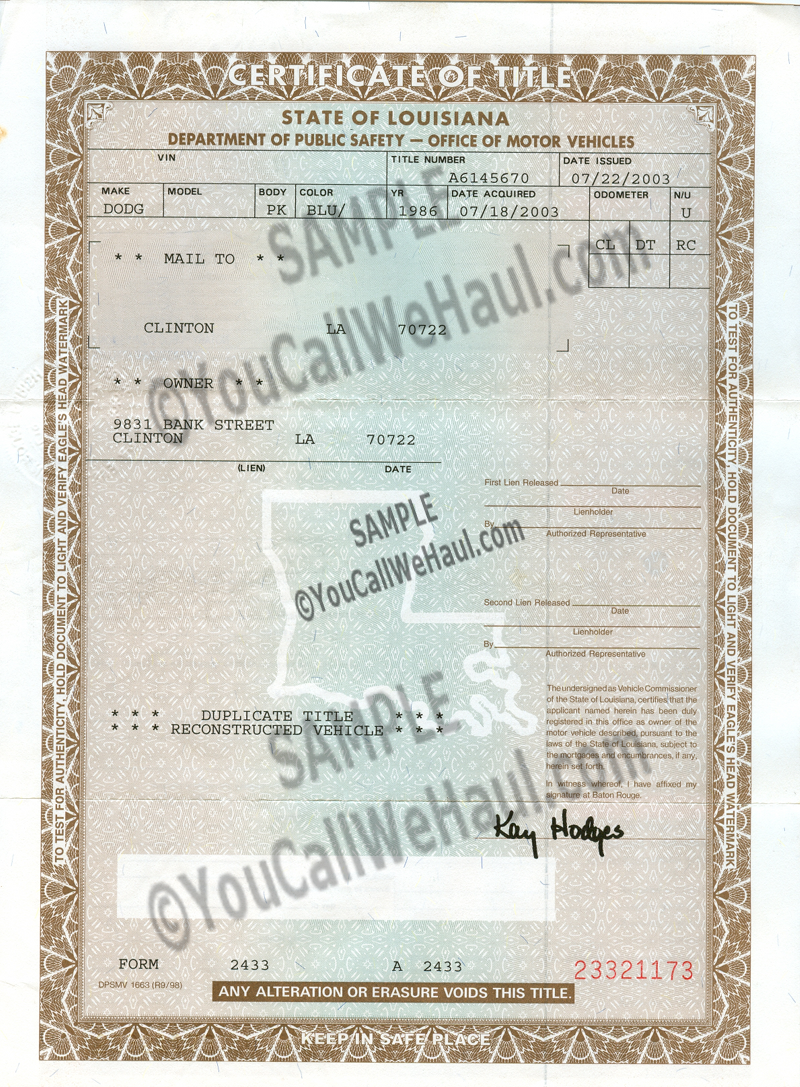

If you want to gift a car in Louisiana, there are a few things you need to keep in mind. Firstly, you’ll need to sign the title over to the person you’re gifting the car to. This means that the title will need to be transferred into their name. You’ll also need to provide them with a bill of sale, which serves as proof of the transaction.

It’s important to note that you’ll need to pay a gift tax when you transfer the title. The tax is based on the fair market value of the car, and you’ll need to pay it within 30 days of the transfer. The person receiving the car will also need to pay a registration fee and any applicable sales tax.

The Benefits of Gifting a Car in Louisiana

Gifting a car can be a great way to show someone you care. It can also be a practical solution if you have a car that you no longer need or want. By gifting the car, you can save the recipient money and provide them with a reliable means of transportation.

Another benefit of gifting a car is that it can help you avoid paying sales tax. In Louisiana, sales tax is based on the purchase price of a car. If you gift a car, you won’t need to pay sales tax on the transaction.

Gifting a Car vs. Selling a Car in Louisiana

When deciding whether to gift or sell a car in Louisiana, there are a few things to consider. If you sell the car, you’ll receive money for it, which can be helpful if you need the funds. However, you’ll also need to pay sales tax on the transaction, which can be expensive.

Gifting a car, on the other hand, can be a more affordable option. You won’t need to pay sales tax on the transaction, and you can help someone in need. However, you won’t receive any money for the car, so it’s important to consider whether you can afford to give it away.

The Process of Gifting a Car in Louisiana

To gift a car in Louisiana, you’ll need to follow a few steps. Firstly, you’ll need to sign the title over to the person you’re gifting the car to. You’ll also need to provide them with a bill of sale.

Next, you’ll need to pay the gift tax within 30 days of the transfer. The tax is based on the fair market value of the car, so it’s important to have an accurate estimate of the value.

Finally, the recipient of the car will need to pay a registration fee and any applicable sales tax. They’ll also need to apply for a new title in their name.

Conclusion

Gifting a car in Louisiana can be a great way to help someone in need and avoid paying sales tax. However, it’s important to follow the proper process to ensure that the transfer is legal and valid. By signing the title over, providing a bill of sale, and paying the gift tax, you can ensure that the transaction goes smoothly.

Contents

Frequently Asked Questions

Here are some frequently asked questions about gifting a car in Louisiana:

Can you gift a car in Louisiana?

Yes, you can gift a car in Louisiana. However, there are certain steps you need to follow to ensure that the transfer of ownership is legal and properly documented. The Louisiana Office of Motor Vehicles (OMV) requires that both the seller and the recipient of the vehicle fill out the proper paperwork to transfer the title.

The gift giver will need to sign over the title to the recipient, and the recipient will need to bring the signed title, along with other required documents, to the OMV to complete the transfer process. It’s important to note that gifting a car may still incur taxes, so it’s important to check with the OMV to determine what fees may apply.

What documents are needed to gift a car in Louisiana?

When gifting a car in Louisiana, both the seller and the recipient will need to fill out and sign the vehicle’s title. The title should also include the vehicle’s current odometer reading, the date of the sale, and the sale price (if applicable).

In addition to the signed title, the recipient will need to bring the title application, a bill of sale (if applicable), and proof of insurance to the Louisiana OMV. The OMV may also require other documents, so it’s important to check with your local office to ensure that you have everything you need to complete the transfer.

Do I need to pay taxes on a gifted car in Louisiana?

Yes, you may still need to pay taxes on a gifted car in Louisiana. The Louisiana OMV requires that sales tax be paid on the fair market value of the vehicle at the time of the transfer. However, there are certain exemptions that may apply to gift transfers, such as transfers between spouses or transfers to a surviving spouse.

If you’re considering gifting a car in Louisiana, it’s a good idea to check with the OMV to determine what fees and taxes may apply to your specific situation.

Can I gift a car to someone out of state?

Yes, you can gift a car to someone out of state. However, the transfer process may be slightly different than if you were transferring ownership within Louisiana. The recipient will need to follow the transfer process for their state of residence, and may need to provide additional documentation, such as a VIN inspection or emissions test.

It’s important to note that taxes and fees may also vary depending on the recipient’s state of residence. If you’re considering gifting a car to someone out of state, it’s a good idea to check with both your local OMV and the recipient’s local DMV to ensure that you have all of the necessary paperwork and information.

What if the gifted car is not operational?

If the gifted car is not operational, the transfer process may be slightly different. The Louisiana OMV requires that all vehicles have a valid inspection before they can be registered, and may require additional documentation for non-operational vehicles.

It’s important to check with the OMV to determine what specific requirements may apply to your situation. In some cases, you may need to obtain a salvage title for a non-operational vehicle, or have the vehicle towed to the OMV for inspection and registration.

How To Gift A Vehicle To Someone Without Paying Taxes

In conclusion, gifting a car in Louisiana is possible, but it involves some important steps. First, make sure that you have all the necessary paperwork, including the title and bill of sale. Then, you will need to transfer ownership of the vehicle by completing the necessary forms and paying the required fees. Finally, don’t forget to update the vehicle’s registration and insurance to reflect the new owner’s information.

Overall, gifting a car can be a great way to show someone that you care, but it’s important to make sure that you follow all the proper procedures to avoid any legal or financial issues down the road. By taking the time to do things right, you can ensure that your gift is truly appreciated and enjoyed for years to come. So if you’re considering gifting a car in Louisiana, be sure to do your research and get all the information you need before proceeding.

Rakibul Hasan, the CEO and founder of Autosdonation, is an automotive specialist with over a decade of industry experience. With a distinct mastery in car donations, sponsorships, and gifting, Rakibul combines his passion for automobiles and generosity to revolutionize the car donation landscape. He established Autosdonation to facilitate the car donation and gifting process, making it more accessible and enjoyable for all involved.

More Posts