Rakibul Hasan, the CEO and founder of Autosdonation, is an automotive specialist with over a decade of industry experience. With a distinct mastery in car...Read more

Are you planning to gift a car in Kentucky? If so, you may be wondering about the legal requirements and process involved in doing so. Fortunately, gifting a car in Kentucky is possible, but it’s important to understand the steps involved to ensure a smooth and legal transfer of ownership. In this article, we will guide you through the process of gifting a car in Kentucky, including the necessary paperwork and legal considerations. So, let’s get started!

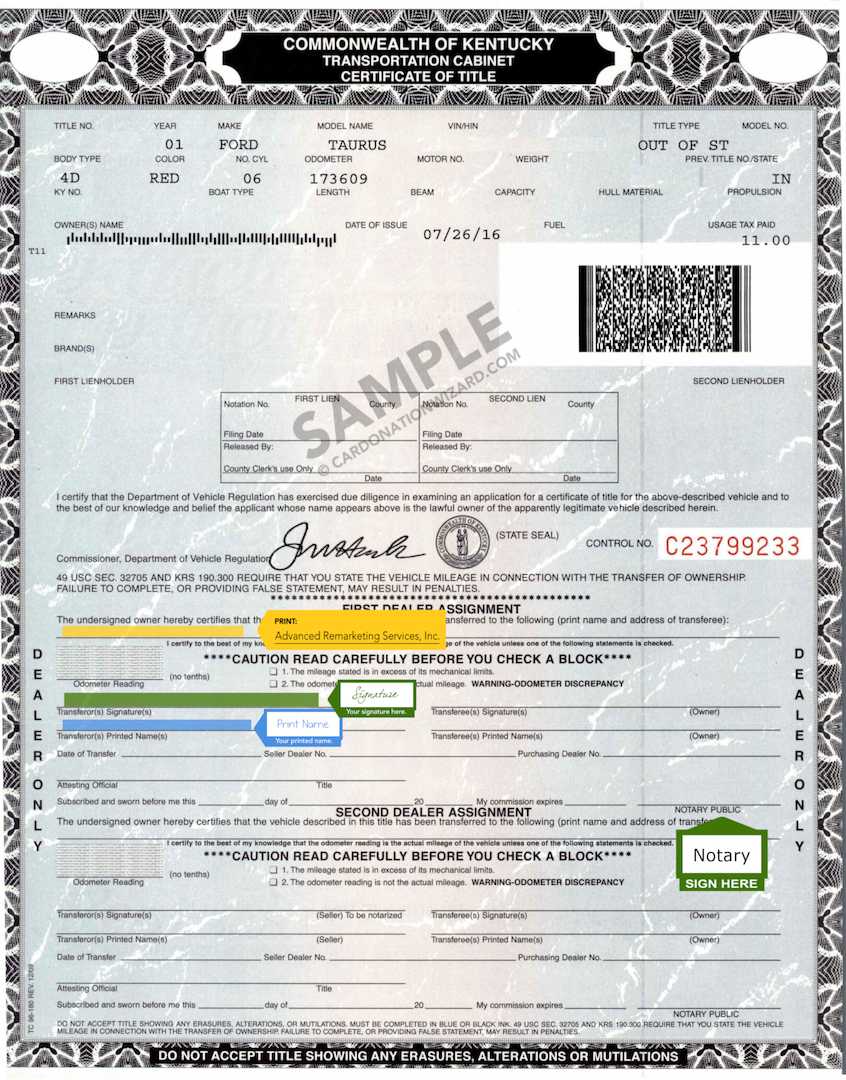

Yes, you can gift a car in Kentucky. However, there are certain steps that must be followed. The donor must sign the back of the car title and give it to the recipient. The recipient must then take the signed title to the county clerk’s office to transfer ownership and pay the necessary fees. It is also recommended to complete a bill of sale and obtain a gift letter to avoid any confusion or legal issues in the future.

Can You Gift a Car in Kentucky?

If you are thinking of gifting a car to someone in Kentucky, there are a few things you need to know. Gifting a car involves transferring the ownership of the vehicle without receiving any monetary compensation. The process of gifting a car in Kentucky is not difficult, but there are some important steps you need to follow.

Step 1: Verify Ownership

Before gifting a car in Kentucky, you need to make sure that you are the legal owner of the vehicle. If you are not the owner, you cannot gift the car. Check the title of the vehicle to ensure that your name is listed as the owner. If you have lost the title, you will need to apply for a duplicate title from the Kentucky Transportation Cabinet.

Once you have the title, you need to sign it over to the recipient. Make sure to include the date of the transfer and the odometer reading at the time of the transfer. You will also need to provide a bill of sale to the recipient.

Step 2: Complete a Bill of Sale

A bill of sale is a legal document that records the transfer of ownership of a vehicle. In Kentucky, a bill of sale is required when transferring ownership of a vehicle. The bill of sale should include the following information:

– The names and addresses of the buyer and seller

– The make, model, and year of the vehicle

– The vehicle identification number (VIN)

– The date of the sale

– The purchase price (if any)

Both the buyer and seller should sign the bill of sale, and each party should keep a copy for their records.

Step 3: Transfer the License Plates

In Kentucky, license plates stay with the owner, not the vehicle. If you are gifting a car, you need to remove the license plates and return them to the Kentucky Transportation Cabinet. The recipient will need to apply for new license plates.

Step 4: Notify the Kentucky Transportation Cabinet

After you have transferred ownership of the vehicle, you need to notify the Kentucky Transportation Cabinet. You can do this by completing a Notice of Transfer of Ownership of a Motor Vehicle form. This form notifies the Kentucky Transportation Cabinet that you are no longer the owner of the vehicle and releases you from any liability related to the vehicle.

Benefits of Gifting a Car

Gifting a car can be a great way to help out a friend or family member who needs a vehicle. It can also be a way to avoid paying sales tax on the transfer of ownership. In Kentucky, if you gift a car to a family member, you are exempt from paying sales tax on the transfer.

Gifting a Car vs. Selling a Car

There are some key differences between gifting a car and selling a car. When you sell a car, you typically receive money in exchange for the vehicle. This means that you will need to pay sales tax on the transfer of ownership. When you gift a car, you do not receive any money, which means that you are exempt from paying sales tax on the transfer.

Another difference is that when you sell a car, you are responsible for providing a warranty to the buyer. When you gift a car, you are not required to provide a warranty.

Conclusion

Gifting a car in Kentucky is a simple process, but it is important to follow the proper steps to ensure that the transfer of ownership is legal and binding. By verifying ownership, completing a bill of sale, transferring the license plates, and notifying the Kentucky Transportation Cabinet, you can gift a car to a friend or family member without any complications.

Frequently Asked Questions

Can you gift a car in Kentucky?

Yes, you can gift a car in Kentucky. However, there are some steps you need to follow to ensure that the transfer of ownership is legal and valid. You need to provide the necessary documentation and pay the required fees to complete the transfer process.

The vehicle’s title must be signed by the donor and the recipient, indicating that the car has been gifted. The recipient must also complete the necessary forms and pay the required taxes and fees to register the car in their name.

What documents are needed to gift a car in Kentucky?

To gift a car in Kentucky, you need to provide the vehicle’s title, a completed Application for Kentucky Certificate of Title or Registration (Form TC 96-182), and a notarized bill of sale. You also need to provide proof of insurance and pay the necessary taxes and fees.

If the vehicle’s title is not available, you need to obtain a duplicate title from the Kentucky Transportation Cabinet. The donor must sign the title over to the recipient and complete the necessary forms to transfer ownership.

Do you need to pay taxes when gifting a car in Kentucky?

Yes, you need to pay taxes when gifting a car in Kentucky. The recipient of the vehicle is responsible for paying the sales tax on the fair market value of the car at the time of transfer. The current sales tax rate in Kentucky is 6%.

The recipient must also pay a title transfer fee and a registration fee to register the vehicle in their name. These fees vary depending on the age and value of the vehicle.

What is the gift tax limit for a car in Kentucky?

There is no gift tax limit for a car in Kentucky. However, the recipient of the vehicle is responsible for paying the sales tax on the fair market value of the car at the time of transfer. The current sales tax rate in Kentucky is 6%.

If the donor has already paid sales tax on the vehicle, they can provide proof of payment to the recipient to avoid paying the tax again.

Can you gift a car to a family member in Kentucky?

Yes, you can gift a car to a family member in Kentucky. The process is the same as gifting a car to anyone else. You need to provide the necessary documentation, pay the required fees, and follow the steps to transfer ownership.

The recipient must also pay the necessary taxes and fees to register the car in their name. They may be eligible for a reduced sales tax rate if they are an immediate family member of the donor.

How To Gift A Vehicle To Someone Without Paying Taxes

In conclusion, gifting a car in Kentucky is possible and can be a great way to transfer ownership of a vehicle. However, it’s important to understand the legal requirements and procedures involved in the process.

Firstly, both the giver and the receiver of the car must sign and date the title transfer form. This form should be submitted to the Kentucky Transportation Cabinet within 15 days of the transfer.

Secondly, the receiver must register the car in their name and pay any applicable fees and taxes. Failure to complete these steps can result in legal and financial consequences.

Overall, while gifting a car may seem like a simple process, it’s important to follow the correct procedures to ensure a smooth and legal transfer of ownership. By doing so, both the giver and receiver can enjoy the benefits of a successful car gift.

Rakibul Hasan, the CEO and founder of Autosdonation, is an automotive specialist with over a decade of industry experience. With a distinct mastery in car donations, sponsorships, and gifting, Rakibul combines his passion for automobiles and generosity to revolutionize the car donation landscape. He established Autosdonation to facilitate the car donation and gifting process, making it more accessible and enjoyable for all involved.

More Posts