Rakibul Hasan, the CEO and founder of Autosdonation, is an automotive specialist with over a decade of industry experience. With a distinct mastery in car...Read more

Are you planning to gift a car to someone in Oregon? You may be wondering if it is possible and what the requirements are. Well, the good news is that it is possible to gift a car in Oregon, but there are specific steps you need to follow to ensure a smooth transfer of ownership.

Before you start the gift-giving process, it’s important to understand the legal requirements and paperwork needed to complete the transfer. In this article, we’ll guide you through the steps you need to take to gift a car in Oregon and answer some common questions you may have along the way. So, let’s get started!

Contents

- Can You Gift a Car in Oregon?

- Frequently Asked Questions

- 1. Can you gift a car in Oregon?

- 2. What documents are needed to gift a car in Oregon?

- 3. Do you have to pay taxes when gifting a car in Oregon?

- 4. Can you gift a car to someone out of state?

- 5. What are the consequences of not transferring ownership when gifting a car in Oregon?

- Oregon Title Transfer – BUYER Instructions

Can You Gift a Car in Oregon?

Gifting a car in Oregon can be a great way to show someone that you care about them. However, before you give away your car, it’s important to know the laws and regulations in Oregon regarding car gifting. In this article, we’ll discuss everything you need to know about gifting a car in Oregon.

What is Car Gifting in Oregon?

Car gifting is the process of giving a vehicle to someone else as a gift. In Oregon, car gifting is a legal process that involves transferring the ownership of the vehicle to the recipient. The process requires specific documents and fees to be paid, depending on the circumstances of the transfer.

To gift a car in Oregon, the vehicle must be titled in the state of Oregon, and the recipient must be a resident of Oregon. If the vehicle is titled in another state, the transfer of ownership must be completed in that state.

How to Gift a Car in Oregon?

To gift a car in Oregon, you need to complete the following steps:

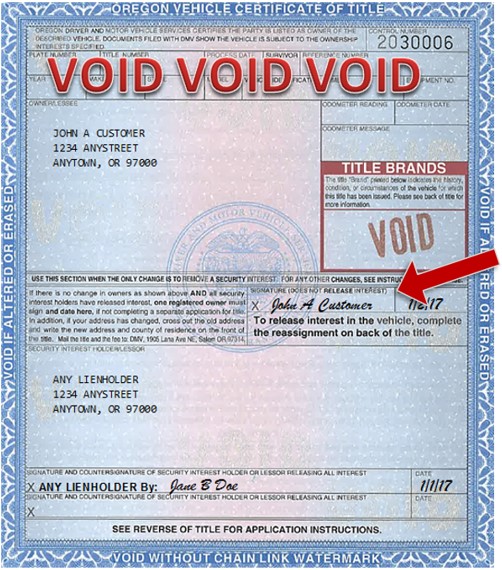

1. Fill out the title transfer section of the vehicle’s title certificate. Be sure to include the recipient’s name and address.

2. Complete a Bill of Sale, which includes the purchase price, date of sale, and seller and buyer information.

3. Complete an odometer disclosure statement if the vehicle is less than 10 years old.

4. Pay the title transfer fees, which vary depending on the county you live in and the age of the vehicle.

5. Submit the title transfer and other required documents to the Oregon DMV.

Benefits of Gifting a Car in Oregon

There are many benefits to gifting a car in Oregon, including:

1. Showing someone you care about them by giving them a valuable gift.

2. Avoiding the hassle of selling the car yourself.

3. Potentially saving money on taxes if the car is gifted to a family member.

4. Helping someone who needs a car but cannot afford to purchase one.

Gifting a Car vs. Selling a Car

While gifting a car in Oregon has its benefits, selling a car can also be a good option. Here are some things to consider when deciding between gifting or selling a car:

1. Selling a car allows you to get money for the vehicle, while gifting a car is a one-way transaction.

2. Gifting a car can be more personal and meaningful than selling a car.

3. Gifting a car can have tax implications, while selling a car usually does not.

4. Selling a car can be a more straightforward process than gifting a car, as there are no specific requirements or fees to be paid.

Conclusion

Gifting a car in Oregon can be a great way to show someone that you care about them. However, it’s important to know the laws and regulations in Oregon regarding car gifting before you give away your car. By following the steps outlined in this article, you can gift a car in Oregon with confidence and ease.

Frequently Asked Questions

In Oregon, gifting a car is a common practice. However, there are some legal requirements that must be followed in order to transfer ownership of the vehicle. Here are some frequently asked questions about gifting a car in Oregon.

1. Can you gift a car in Oregon?

Yes, you can gift a car in Oregon. However, you must follow the legal requirements for transferring ownership of the vehicle. The process is similar to selling a car, but there is no monetary exchange involved. You will need to complete the necessary paperwork and submit it to the Oregon Department of Motor Vehicles (DMV).

When gifting a car in Oregon, it is important to make sure that the person receiving the vehicle is eligible to register it. They must have a valid driver’s license and be able to provide proof of insurance. Additionally, they will be responsible for paying any applicable registration fees and taxes.

2. What documents are needed to gift a car in Oregon?

When gifting a car in Oregon, you will need to provide the recipient with the vehicle’s title, which must be signed and dated by the seller. You will also need to complete a Bill of Sale, which should include the vehicle’s make, model, year, and VIN number, as well as the names and addresses of both the buyer and seller.

Additionally, both the buyer and seller will need to complete a Release of Interest form, which is used to notify the DMV that the vehicle has been transferred to a new owner. The buyer will also need to provide proof of insurance and pay any applicable taxes and fees.

3. Do you have to pay taxes when gifting a car in Oregon?

Yes, you may be required to pay taxes when gifting a car in Oregon. The amount of tax you will need to pay depends on the value of the vehicle and the relationship between the buyer and seller. If the vehicle is worth less than $16,000 and the buyer is a family member, there is no tax due. If the vehicle is worth more than $16,000, or if the buyer is not a family member, taxes will be calculated based on the vehicle’s value.

You can find more information about the tax requirements for gifting a car in Oregon on the website of the Oregon Department of Revenue.

4. Can you gift a car to someone out of state?

Yes, you can gift a car to someone out of state. However, the process for transferring ownership will vary depending on the state in which the recipient lives. You will need to contact the DMV in the recipient’s state to find out what paperwork is required and how to submit it.

It is also important to note that the recipient may be required to pay taxes and fees in their home state, even if they received the vehicle as a gift.

5. What are the consequences of not transferring ownership when gifting a car in Oregon?

If you do not transfer ownership of a gifted car in Oregon, you may be held liable for any accidents or other incidents involving the vehicle. Additionally, if the recipient of the vehicle is unable to register it in their name, you may be responsible for any fines or penalties that result from driving an unregistered vehicle.

To protect yourself and the recipient of the vehicle, it is important to complete the necessary paperwork and submit it to the DMV in a timely manner.

Oregon Title Transfer – BUYER Instructions

In conclusion, the state of Oregon allows car gifting, but there are certain requirements that must be met. Both the donor and recipient must sign the title and complete a bill of sale. The recipient must also pay all applicable taxes and fees before the transfer of ownership can be completed.

It’s important to note that gifting a car in Oregon can have tax implications for both parties involved. The donor may be subject to gift tax, while the recipient may need to pay use tax on the fair market value of the vehicle.

Overall, gifting a car in Oregon can be a great way to show your generosity and help someone in need. Just make sure to follow the proper procedures and consult with a tax professional to avoid any unexpected financial consequences.

Rakibul Hasan, the CEO and founder of Autosdonation, is an automotive specialist with over a decade of industry experience. With a distinct mastery in car donations, sponsorships, and gifting, Rakibul combines his passion for automobiles and generosity to revolutionize the car donation landscape. He established Autosdonation to facilitate the car donation and gifting process, making it more accessible and enjoyable for all involved.

More Posts