Rakibul Hasan, the CEO and founder of Autosdonation, is an automotive specialist with over a decade of industry experience. With a distinct mastery in car...Read more

Giving a car as a gift is a generous gesture that can make someone’s day. However, there are certain legal formalities that must be followed to ensure that the transfer of ownership is done correctly. In Alabama, gifting a car involves a specific process that must be followed to avoid any future complications. In this article, we will guide you through the steps required to gift a car in Alabama, making the process as easy and stress-free as possible. So, let’s dive in and learn how to gift a car in Alabama like a pro!

How to Gift a Car in Alabama

To gift a car in Alabama, the donor and recipient must fill out the vehicle’s title. The donor must sign and date the title and provide an odometer reading. The recipient must sign and date the title and pay the necessary fees to transfer ownership. Additionally, the recipient must have insurance on the car before transferring ownership. Once completed, submit the title and necessary fees to the Alabama Department of Revenue.

How to Gift a Car in Alabama: A Comprehensive Guide

Understanding the Requirements for Gifting a Car in Alabama

Gifting a car in Alabama can be a straightforward process, but you need to understand the requirements before you start. The first thing you need to do is to make sure that you are the legal owner of the car. You also need to ensure that there are no liens or financing agreements on the vehicle that could prevent you from gifting it.

Once you have confirmed that you are the legal owner of the car, you need to obtain the vehicle’s title. The title transfer process can vary depending on the situation, so you need to check with the Alabama Department of Revenue’s Motor Vehicle Division to ensure that you have the correct forms and documentation.

The Benefits of Gifting a Car in Alabama

Gifting a car in Alabama can have several advantages, including:

– Avoiding sales tax.

– Simplifying estate planning.

– Helping a loved one in need.

Gifting vs. Selling a Car in Alabama

While selling a car in Alabama can be a good option, gifting a car can be an excellent choice for several reasons. For example, if you gift a car to a family member or friend, you can avoid paying sales tax. Additionally, gifting a car can be a more straightforward process than selling it, which can save time and hassle.

Steps to Gifting a Car in Alabama

If you want to gift a car in Alabama, here are the steps you need to follow:

Step 1: Confirm Ownership of the Vehicle

Before you can gift a car in Alabama, you need to ensure that you are the legal owner of the vehicle.

Step 2: Obtain the Vehicle Title

You need to obtain the vehicle title before you can gift a car in Alabama. The title transfer process can vary, so you need to check with the Alabama Department of Revenue’s Motor Vehicle Division to ensure that you have the correct documentation.

Step 3: Fill Out the Title Transfer Forms

After you have obtained the vehicle title, you need to fill out the title transfer forms. The forms will require information about both the donor and the recipient of the vehicle.

Step 4: Submit the Title Transfer Forms

Once you have completed the title transfer forms, you need to submit them to the Alabama Department of Revenue’s Motor Vehicle Division. You will also need to pay any applicable fees, such as title transfer fees.

Step 5: Transfer the License Plates

If you want to transfer the license plates to the recipient of the vehicle, you need to fill out a special form and submit it to the Alabama Department of Revenue’s Motor Vehicle Division.

Conclusion

Gifting a car in Alabama can be a great way to help a loved one or simplify estate planning. However, you need to understand the requirements and follow the correct steps to ensure a smooth transfer of ownership. By following the steps outlined above, you can gift a car in Alabama with confidence.

Contents

Frequently Asked Questions

Here are some of the most common questions people have about how to write a letter gifting a car in Alabama. Read on to find out more.

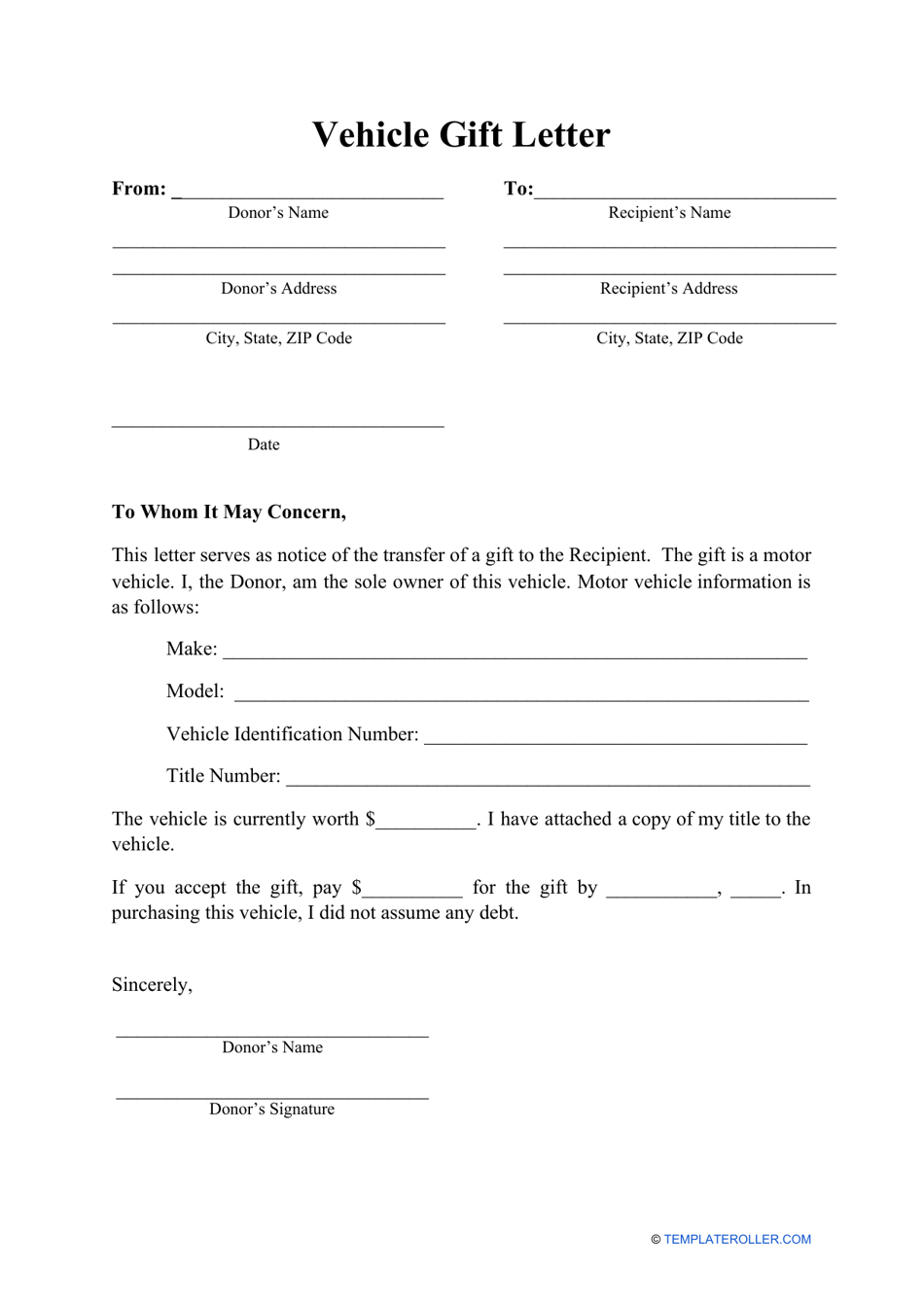

What should I include in a letter gifting a car in Alabama?

When writing a letter gifting a car in Alabama, it is important to include some key information. First, you should include the make, model, and year of the car. You should also include the VIN number, as well as the current mileage. Additionally, you should include your name and contact information, as well as the name and contact information of the person receiving the car. Finally, you should include a statement indicating that you are gifting the car to the recipient, and that there is no expectation of payment or compensation in return.

It is also a good idea to include any relevant documentation, such as the car’s title or registration, to help facilitate the transfer of ownership. Be sure to keep a copy of the letter for your records, and consider sending it via certified mail to ensure it is received.

Do I need to have the car appraised before gifting it?

While it is not required to have the car appraised before gifting it in Alabama, it may be a good idea to do so. This can help establish the car’s value for tax purposes, and can provide documentation in the event of any disputes or legal issues down the line. If you do decide to have the car appraised, be sure to include a copy of the appraisal in your letter gifting the car.

Regardless of whether or not you choose to have the car appraised, it is important to include a statement in your letter indicating that you are gifting the car without any expectation of payment or compensation in return. This can help protect you from any potential liability or legal issues that may arise in the future.

Can I gift a car to someone who lives out of state?

Yes, you can gift a car to someone who lives out of state in Alabama. However, there may be additional steps you need to take to transfer ownership of the car. For example, you may need to obtain a new title or registration for the car in the recipient’s state. Additionally, you may need to provide additional documentation or paperwork to complete the transfer of ownership.

Before gifting a car to someone who lives out of state, it is a good idea to research the specific requirements for transferring ownership in that state. This can help ensure that the process goes smoothly and that there are no unexpected complications or issues.

Do I need to pay taxes when gifting a car in Alabama?

Yes, you may be required to pay taxes when gifting a car in Alabama, depending on the value of the car. The recipient of the car may also be required to pay taxes on the transfer of ownership. It is important to research the specific tax requirements in Alabama to ensure that you are in compliance with all applicable laws and regulations.

If you are unsure about whether or not you need to pay taxes on the gift, you may want to consult with a tax professional or attorney. They can provide guidance and advice based on your specific situation and help ensure that you are in compliance with all relevant laws and regulations.

What happens if the person I gift the car to gets into an accident?

If the person you gift the car to gets into an accident, they will be responsible for any damages or liability that may arise. However, it is still important to include a statement in your letter indicating that you are gifting the car without any expectation of payment or compensation in return. This can help protect you from any potential liability or legal issues that may arise in the future.

If you are concerned about potential liability issues, you may want to consider including additional language in your letter, such as a statement indicating that the recipient assumes all responsibility for the car and any associated risks or liabilities.

In conclusion, gifting a car in Alabama is a straightforward process that requires a few important steps. First, make sure you have all the necessary documentation, including the car’s title and a bill of sale. Next, fill out the appropriate forms and have them notarized. Finally, submit the forms and documentation to the Alabama Department of Revenue, and you’re all set!

Remember, gifting a car can be a generous and thoughtful gesture, but it’s important to do it right to avoid any legal or financial issues down the line. By following these simple steps, you can ensure that the process goes smoothly and that both you and the recipient are happy with the outcome.

In summary, gifting a car in Alabama is a great way to show someone you care, but it’s important to do it correctly. By taking the time to gather all the necessary documentation, fill out the appropriate forms, and submit everything to the right place, you can ensure that the process goes smoothly and that everyone involved is happy with the outcome. So go ahead and give the gift of a car – just be sure to do it right!

Rakibul Hasan, the CEO and founder of Autosdonation, is an automotive specialist with over a decade of industry experience. With a distinct mastery in car donations, sponsorships, and gifting, Rakibul combines his passion for automobiles and generosity to revolutionize the car donation landscape. He established Autosdonation to facilitate the car donation and gifting process, making it more accessible and enjoyable for all involved.

More Posts