Rakibul Hasan, the CEO and founder of Autosdonation, is an automotive specialist with over a decade of industry experience. With a distinct mastery in car...Read more

If you’re planning to give or receive a vehicle as a gift in Rhode Island, you might be wondering whether you’ll have to pay sales tax on it. The answer is not as straightforward as you might think, as there are several factors that can impact whether or not sales tax applies to a gifted vehicle in Rhode Island.

To help you understand the rules and regulations surrounding sales tax on gifted vehicles in Rhode Island, we’ve done some research and put together this guide. Whether you’re the giver or the receiver of a gifted vehicle, we hope this information will help you navigate the process with ease and confidence.

Yes, there is sales tax on a gifted vehicle in Rhode Island. The sales tax is based on the fair market value of the vehicle and must be paid by the recipient of the gift. The tax rate in Rhode Island is currently 7%. It is important to note that if the vehicle was gifted between family members, there may be exemptions or reduced rates available.

Contents

- Understanding Sales Tax on Gifted Vehicles in Rhode Island

- Frequently Asked Questions

- 1. Is there sales tax on a gifted vehicle in Rhode Island?

- 2. How is the fair market value of a gifted vehicle determined?

- 3. What if the gifted vehicle was purchased out of state?

- 4. Can the gift giver pay the use tax instead of the recipient?

- 5. Are there any other taxes or fees associated with gifted vehicles in Rhode Island?

- What is the Car Sales Tax in Rhode Island?

Understanding Sales Tax on Gifted Vehicles in Rhode Island

What is a Gifted Vehicle?

A gifted vehicle is a car, truck, or motorcycle that is given as a gift from one person to another. This can be a generous gesture between family members, friends, or even as a prize in a contest. However, when it comes to taxes, the gifted vehicle is treated differently than a purchased vehicle.

It’s important to note that a gifted vehicle is not the same as a vehicle that is sold for a nominal amount, such as $1. In Rhode Island, any vehicle that is sold for less than market value is still subject to sales tax.

Is There Sales Tax on a Gifted Vehicle in Rhode Island?

Yes, there is sales tax on a gifted vehicle in Rhode Island. The state views the transfer of a gifted vehicle as a sale, and therefore requires the payment of sales tax. The sales tax is based on the fair market value (FMV) of the vehicle at the time of the transfer.

In Rhode Island, the sales tax rate for motor vehicles is currently 7%. So, if the FMV of the gifted vehicle is $10,000, the sales tax would be $700. The person receiving the gifted vehicle is responsible for paying the sales tax to the Rhode Island Division of Motor Vehicles (DMV).

Are There Any Exemptions to the Sales Tax on Gifted Vehicles?

There are certain exemptions to the sales tax on gifted vehicles in Rhode Island. These exemptions include:

- Transfers between spouses or former spouses

- Transfers between parents and children

- Transfers between siblings

- Transfers between grandparents and grandchildren

- Transfers between stepparents and stepchildren

- Transfers between legal guardians and wards

- Transfers between employer and employee for work-related purposes

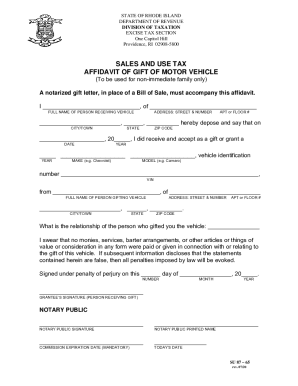

If the transfer falls into one of these categories, the recipient of the gifted vehicle may be exempt from paying the sales tax. However, they must still complete the necessary paperwork and provide proof of the relationship between the parties involved.

What Happens if the Sales Tax is Not Paid?

If the recipient of the gifted vehicle fails to pay the required sales tax, they may face penalties and fines. The Rhode Island DMV may also refuse to register the vehicle until the sales tax is paid in full.

It’s important to note that attempting to avoid paying the sales tax on a gifted vehicle is illegal and can result in serious consequences. It’s always best to follow the proper procedures and pay any required taxes to avoid any legal issues in the future.

Conclusion

While receiving a gifted vehicle can be an exciting and generous gesture, it’s important to understand the tax implications of the transfer. In Rhode Island, sales tax is required on gifted vehicles, with certain exemptions for transfers between family members and other specific relationships. By following the proper procedures and paying any required taxes, the recipient of the gifted vehicle can avoid penalties and legal issues in the future.

Frequently Asked Questions

Here are some common questions and answers about sales tax on gifted vehicles in Rhode Island:

1. Is there sales tax on a gifted vehicle in Rhode Island?

Yes, there is sales tax on a gifted vehicle in Rhode Island. According to the Rhode Island Division of Motor Vehicles, the recipient of a gifted vehicle must pay a use tax on the fair market value of the vehicle at the time of transfer. The use tax rate in Rhode Island is 7%.

However, if the vehicle was gifted to a spouse or a child, the use tax may be waived. In order to qualify for the waiver, the recipient must provide proof of the relationship and complete the proper forms with the Division of Motor Vehicles.

2. How is the fair market value of a gifted vehicle determined?

The fair market value of a gifted vehicle in Rhode Island is determined by several factors, including the make, model, year, and condition of the vehicle. The Division of Motor Vehicles may use various sources to determine the fair market value, such as the NADA Guide or Kelley Blue Book.

If the gift giver provides a bill of sale or other documentation that indicates the purchase price of the vehicle, that amount may be used to determine the fair market value for tax purposes.

3. What if the gifted vehicle was purchased out of state?

If the gifted vehicle was purchased out of state, the recipient must still pay use tax on the fair market value of the vehicle at the time of transfer. The use tax rate in Rhode Island is the same for out-of-state purchases as it is for in-state purchases: 7%.

The recipient may be required to provide proof of the purchase price or fair market value of the vehicle, such as a bill of sale or appraisal, in order to determine the amount of use tax owed.

4. Can the gift giver pay the use tax instead of the recipient?

Yes, the gift giver may choose to pay the use tax on the gifted vehicle instead of the recipient. However, the gift giver must indicate their intention to do so on the proper forms with the Division of Motor Vehicles at the time of transfer.

If the gift giver pays the use tax, they will need to provide proof of payment, such as a receipt or canceled check, to the recipient. The recipient will need this documentation in order to register the vehicle in their name.

5. Are there any other taxes or fees associated with gifted vehicles in Rhode Island?

In addition to the use tax on the fair market value of the vehicle, there may be other taxes and fees associated with gifted vehicles in Rhode Island. For example, the recipient may need to pay a registration fee and a title fee in order to register the vehicle in their name.

The amount of these fees will vary depending on the type and age of the vehicle, as well as other factors. It is important for the recipient to check with the Division of Motor Vehicles for a complete list of fees and taxes that may be due at the time of transfer.

What is the Car Sales Tax in Rhode Island?

In conclusion, it is important to understand the sales tax regulations when gifting a vehicle in Rhode Island. While there is no sales tax on a gifted vehicle, there are still some fees and documents that need to be taken care of. It is recommended that both the gifter and the recipient consult with the Rhode Island Division of Motor Vehicles to ensure a smooth transfer of ownership.

Additionally, it is important to note that the recipient of the gifted vehicle may be responsible for paying other fees, such as registration and title fees. These fees may vary depending on the make and model of the vehicle, as well as the recipient’s location.

Overall, gifting a vehicle can be a great way to help out a family member or friend, but it is important to be aware of the necessary steps to ensure a legal and stress-free transfer of ownership. By following the guidelines set forth by the Rhode Island Division of Motor Vehicles, both the gifter and the recipient can enjoy a successful transfer of ownership without any unexpected fees or complications.

Rakibul Hasan, the CEO and founder of Autosdonation, is an automotive specialist with over a decade of industry experience. With a distinct mastery in car donations, sponsorships, and gifting, Rakibul combines his passion for automobiles and generosity to revolutionize the car donation landscape. He established Autosdonation to facilitate the car donation and gifting process, making it more accessible and enjoyable for all involved.

More Posts