Rakibul Hasan, the CEO and founder of Autosdonation, is an automotive specialist with over a decade of industry experience. With a distinct mastery in car...Read more

Are you considering gifting a car to your son in Arkansas? It’s a generous gesture and can be a great help, especially if your son needs a vehicle. However, it’s important to understand the laws and regulations surrounding gifting a car in Arkansas.

Before you make any decisions, it’s crucial to know the requirements and steps involved in transferring ownership of a vehicle. This article will guide you through the process and answer common questions about gifting a car to your son in Arkansas. So, let’s dive in and explore the topic further.

Can I Gift a Car to My Son in Arkansas?

Yes, you can gift a car to your son in Arkansas. However, there are certain steps you need to follow. First, you need to sign the title over to your son, and he needs to register the car in his name. Additionally, he will need to pay the appropriate taxes and fees. It is also recommended to have a written agreement outlining the terms of the gift.

**Can I Gift a Car to My Son in Arkansas?**

If you’re considering gifting a car to your son in Arkansas, there are a few things you need to know. While it is possible to gift a car to a family member, the process can be a bit complicated. In this article, we’ll break down the steps you need to take to gift a car to your son in Arkansas.

**H3: Requirements for Gifting a Car in Arkansas**

Before you can gift a car to your son in Arkansas, there are a few requirements you need to meet. First, you must be the legal owner of the car and have the title in your name. Second, you must have paid off any liens on the car. Finally, you’ll need to have the car inspected and registered in Arkansas.

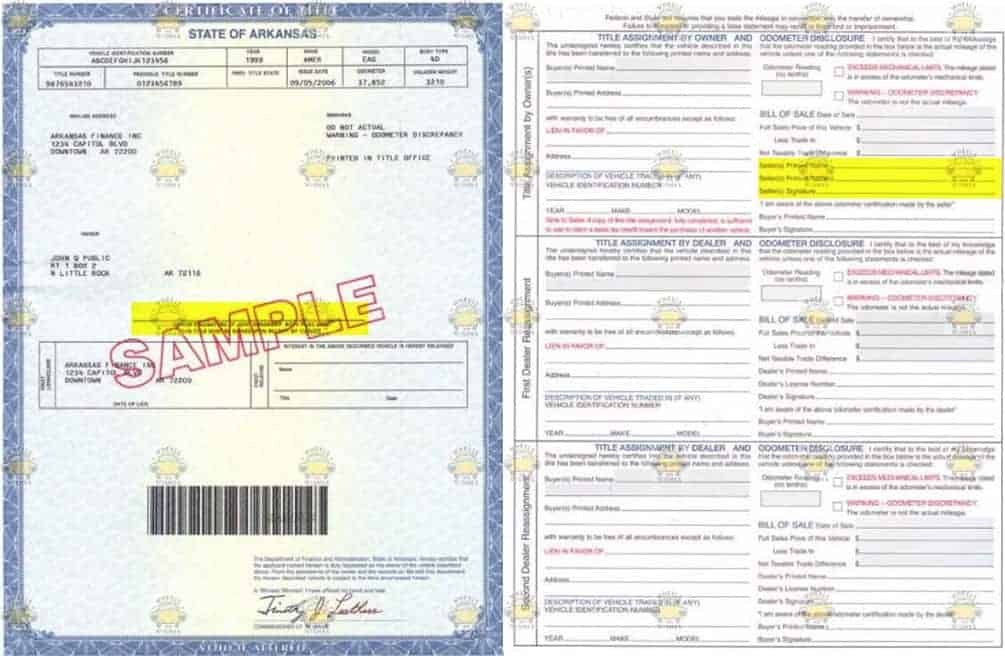

To transfer the title of the car to your son, you’ll need to fill out the back of the title with your son’s name and address. You’ll also need to sign and date the title. If there are any liens on the car, you’ll need to have a lien release form signed by the lien holder.

**H3: Transferring Ownership of the Car**

Once you’ve completed the requirements for gifting a car in Arkansas, you can transfer ownership of the car to your son. You’ll need to fill out a gift affidavit form, which can be obtained from the Arkansas Department of Finance and Administration. This form states that you are gifting the car to your son and that he will be the new owner.

You’ll also need to provide proof of insurance and pay any applicable taxes and fees. Your son will need to take the gift affidavit form, proof of insurance, and the title to the Arkansas Department of Finance and Administration to complete the transfer of ownership.

**H3: Benefits of Gifting a Car to Your Son in Arkansas**

Gifting a car to your son in Arkansas can have several benefits. First, it can be a great way to help him get started on his own. It can also be a way to reduce the amount of taxes you owe, as the gift tax is currently $15,000 per person per year.

Additionally, gifting a car can be a way to show your son that you trust him and believe in his ability to take care of a car. It can also be a way to strengthen your relationship with him and create lasting memories.

**H3: Vs Selling a Car to Your Son**

While gifting a car to your son in Arkansas can be a great option, selling the car may also be a viable choice. If you sell the car to your son, you can set a price and receive payment for the car. This can be a good option if you need the money or if you want to make sure your son has a financial stake in the car.

However, selling the car can also create tension or resentment if your son feels like he is being taken advantage of. Additionally, selling the car can create tax implications for both you and your son.

**H3: Conclusion**

Gifting a car to your son in Arkansas can be a great way to show your love and support. However, you need to make sure you follow the proper steps to transfer ownership of the car. By completing the requirements and filling out the necessary forms, you can make the process as smooth as possible. Whether you choose to gift the car or sell it, the most important thing is to communicate openly with your son and make sure he understands his responsibilities as a car owner.

Contents

Frequently Asked Questions

Here are some frequently asked questions about gifting a car to a son in Arkansas:

Can I gift a car to my son in Arkansas?

Yes, you can gift a car to your son in Arkansas. However, there are certain steps you need to follow in order to transfer the title of the vehicle to your son’s name. First, you need to sign the title over to your son and provide a bill of sale. You also need to provide a gift affidavit if the vehicle is worth more than $4,000.

Your son will need to take these documents to the Arkansas Department of Finance and Administration to register the vehicle in his name and obtain a new title. He will also need to pay any applicable taxes and fees.

Do I need to pay taxes on a gifted car in Arkansas?

Yes, you may need to pay taxes on a gifted car in Arkansas depending on the value of the vehicle. If the vehicle is worth more than $4,000, you will need to provide a gift affidavit and pay taxes on the vehicle based on its fair market value. If the vehicle is worth less than $4,000, you will not need to pay taxes on the gift.

Your son will also be responsible for paying any applicable registration fees and taxes when he registers the vehicle in his name.

What is a gift affidavit?

A gift affidavit is a legal document that certifies that a vehicle was given as a gift. In Arkansas, you are required to provide a gift affidavit if the vehicle is worth more than $4,000 and is being transferred as a gift. The affidavit must be signed by both the giver and the receiver of the gift and must include the make, model, and VIN of the vehicle.

The gift affidavit is used to determine the fair market value of the vehicle for tax purposes. It is important to complete this document accurately to avoid any tax penalties or issues with the transfer of ownership.

What if I lost the title to the car I want to gift?

If you have lost the title to the car you want to gift, you will need to obtain a duplicate title before you can transfer ownership to your son. You can apply for a duplicate title at the Arkansas Department of Finance and Administration by completing an application and paying a fee.

Once you have the duplicate title, you can sign it over to your son and provide the necessary documents to transfer ownership of the vehicle.

Can I gift a car to my son if it has a lien on it?

Yes, you can gift a car to your son even if it has a lien on it. However, you will need to pay off the lien before you can transfer ownership of the vehicle. Once the lien is paid off, you can sign the title over to your son and provide the necessary documents to transfer ownership.

If you are unable to pay off the lien, you may need to work with the lienholder to transfer ownership of the vehicle to your son.

How To Gift A Vehicle To Someone Without Paying Taxes

In conclusion, gifting a car to your son in Arkansas is possible with some specific steps to follow. It is important to ensure that all legal requirements are met, including transferring the title and registration of the vehicle to your son’s name. Additionally, you may need to provide proof of insurance and pay any associated fees or taxes.

Before gifting a car, it is recommended to consult with a legal expert or a motor vehicle department representative to ensure that all necessary steps are taken. This will help to avoid any potential legal issues or complications down the line.

Overall, gifting a car to your son in Arkansas can be a thoughtful and generous gesture. By following the necessary steps and seeking professional guidance, you can ensure a smooth and stress-free transfer of ownership.

Rakibul Hasan, the CEO and founder of Autosdonation, is an automotive specialist with over a decade of industry experience. With a distinct mastery in car donations, sponsorships, and gifting, Rakibul combines his passion for automobiles and generosity to revolutionize the car donation landscape. He established Autosdonation to facilitate the car donation and gifting process, making it more accessible and enjoyable for all involved.

More Posts