Rakibul Hasan, the CEO and founder of Autosdonation, is an automotive specialist with over a decade of industry experience. With a distinct mastery in car...Read more

Are you planning to gift a car or receive one as a gift in Florida? If so, you may be wondering if you can simply write “gift” on the car title. While it may seem like a straightforward answer, there are a few things you need to know before making any changes to the title.

Firstly, the process of gifting a car in Florida is not as simple as just writing “gift” on the title. There are specific steps you need to follow to ensure a smooth transfer of ownership. In this article, we will explore the requirements and legalities of gifting a car in Florida, so you can make an informed decision.

Can You Write Gift on a Car Title in Florida?

If you are looking to transfer the ownership of a vehicle to someone, there are a few things that need to be done to ensure that the process is legal and valid. One of the most important steps is to fill out the car title correctly. In Florida, you may be wondering if you can write “gift” on a car title. In this article, we will explore the answer to this question in detail.

What is a Car Title?

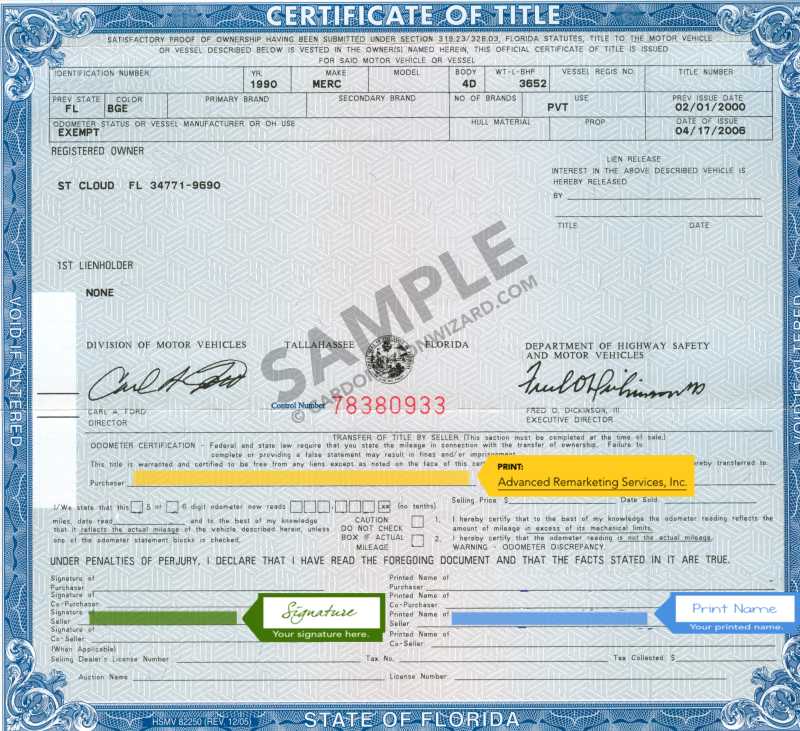

Before we dive into the specifics of writing “gift” on a car title in Florida, let’s first understand what a car title is. A car title is a legal document that proves ownership of a vehicle. It contains essential information about the vehicle, such as the make, model, year, and the vehicle identification number (VIN). Whenever you buy or sell a vehicle, the car title needs to be transferred to the new owner.

What is a Gift Transfer?

A gift transfer is a type of vehicle transfer where the ownership of a vehicle is transferred to another person without any monetary exchange. In other words, the vehicle is given as a gift. In Florida, a gift transfer is treated the same as any other vehicle transfer, and the recipient of the gift will need to have the car title transferred to their name.

How to Transfer a Car Title in Florida?

To transfer a car title in Florida, there are a few steps that you need to follow:

Step 1: Fill out the title transfer section of the car title. This includes the buyer’s name and address, the purchase price, the date of sale, and the odometer reading.

Step 2: Obtain a bill of sale. This document proves that the vehicle was sold and purchased and includes details such as the purchase price, the date of sale, and the names and addresses of the buyer and seller.

Step 3: Obtain a vehicle identification number (VIN) inspection. This is required for vehicles that are currently titled in another state or country.

Step 4: Submit the completed car title, bill of sale, and VIN inspection to the Florida Department of Highway Safety and Motor Vehicles (DHSMV).

Can You Write “Gift” on a Car Title in Florida?

In Florida, you cannot write “gift” on a car title. Instead, you need to fill out the title transfer section of the car title with the recipient’s name and address, the purchase price (which would be $0 for a gift transfer), the date of transfer, and the odometer reading. You also need to obtain a bill of sale and submit it along with the car title to the DHSMV.

Benefits of a Gift Transfer

There are several benefits of a gift transfer, such as:

- No sales tax: Since there is no monetary exchange, there is no sales tax on a gift transfer.

- Low transfer fees: The transfer fees for a gift transfer are lower than those for a regular vehicle transfer.

- Simplicity: A gift transfer is a simple process that requires minimal paperwork.

Gift Transfer vs. Regular Transfer

Here is a comparison of a gift transfer and a regular transfer:

| Gift Transfer | Regular Transfer | |

|---|---|---|

| Sales tax | No sales tax | Sales tax based on purchase price |

| Transfer fees | Lower fees | Higher fees |

| Process | Simple | More paperwork |

In conclusion, a gift transfer is a simple and cost-effective way to transfer ownership of a vehicle. While you cannot write “gift” on a car title in Florida, you can still transfer the vehicle as a gift by filling out the title transfer section of the car title correctly and obtaining a bill of sale. If you have any questions about transferring a car title in Florida, you can contact the DHSMV for assistance.

Frequently Asked Questions

In Florida, there are specific rules and regulations when it comes to car titles and gift transfers. Here are some of the most frequently asked questions about whether you can write “gift” on a car title in Florida:

Can I Write “Gift” on a Car Title in Florida?

It is possible to write “gift” on a car title in Florida. However, it is important to note that there are specific requirements that must be met in order to do so legally. For example, the vehicle must be a gift from one family member to another, and there cannot be any money exchanged between the parties. Additionally, both parties must sign the title and complete a gift affidavit.

It is important to follow the proper procedures when transferring a vehicle as a gift in Florida to avoid any legal issues in the future. If you are unsure about the process, it is recommended to seek the advice of a legal professional.

What is a Gift Affidavit?

A gift affidavit is a legal document that must be completed when transferring a vehicle as a gift in Florida. The affidavit verifies that the transfer is indeed a gift and that no money or other consideration was exchanged between the parties. The affidavit must be signed by both the donor and the recipient and must be notarized.

It is important to note that the gift affidavit must be completed and submitted along with the car title when transferring a vehicle as a gift in Florida. Failure to complete the affidavit correctly could result in legal issues or complications with the title transfer process.

Do I Need to Pay Taxes When Transferring a Car as a Gift in Florida?

Yes, you may be required to pay taxes when transferring a car as a gift in Florida. The amount of tax you will need to pay depends on the value of the vehicle and the relationship between the donor and recipient. If the vehicle is being gifted to a spouse, parent, or child, there may be no tax due. However, if the vehicle is being gifted to a friend or other family member, you may be required to pay a gift tax.

It is important to research the specific tax requirements in Florida before transferring a vehicle as a gift to ensure that you are following the proper procedures and avoiding any legal issues.

Can I Sell a Gifted Car in Florida?

Yes, you can sell a gifted car in Florida. However, it is important to note that the process for selling a gifted car is different than selling a car that you purchased. In order to sell a gifted car, you must first have the car title transferred into your name. Once the title is in your name, you can then sell the car as you would any other vehicle.

If you are unsure about the process for transferring a gifted car into your name, it is recommended to seek the advice of a legal professional or visit your local DMV for guidance.

What Happens if I Don’t Transfer a Gifted Car Title in Florida?

If you do not transfer a gifted car title in Florida, you could face legal issues and complications in the future. The person who gifted you the car may still be held responsible for any accidents or tickets that occur while the car is in your possession, as their name is still on the title. Additionally, if you try to sell the car without transferring the title, you may not be able to complete the sale legally.

It is important to transfer the car title as soon as possible after receiving a gifted vehicle to avoid any potential legal issues or complications down the road.

How to properly fill out a Florida title

In conclusion, the answer to the question “Can you write gift on a car title in Florida?” is yes. However, it is important to follow the proper guidelines and procedures set by the Florida Department of Highway Safety and Motor Vehicles. This includes completing a bill of sale, obtaining a notarized affidavit of gift, and submitting the necessary paperwork to the DMV.

By properly documenting the gift transaction, both the giver and receiver can avoid potential legal issues and ensure a smooth transfer of ownership. It is also important to note that gifts may have tax implications, so it is recommended to consult with a tax professional before making any gift transfers.

Overall, while it may seem simple to write “gift” on a car title, it is important to follow the proper procedures to ensure a legal and hassle-free transfer of ownership.

Rakibul Hasan, the CEO and founder of Autosdonation, is an automotive specialist with over a decade of industry experience. With a distinct mastery in car donations, sponsorships, and gifting, Rakibul combines his passion for automobiles and generosity to revolutionize the car donation landscape. He established Autosdonation to facilitate the car donation and gifting process, making it more accessible and enjoyable for all involved.

More Posts