Rakibul Hasan, the CEO and founder of Autosdonation, is an automotive specialist with over a decade of industry experience. With a distinct mastery in car...Read more

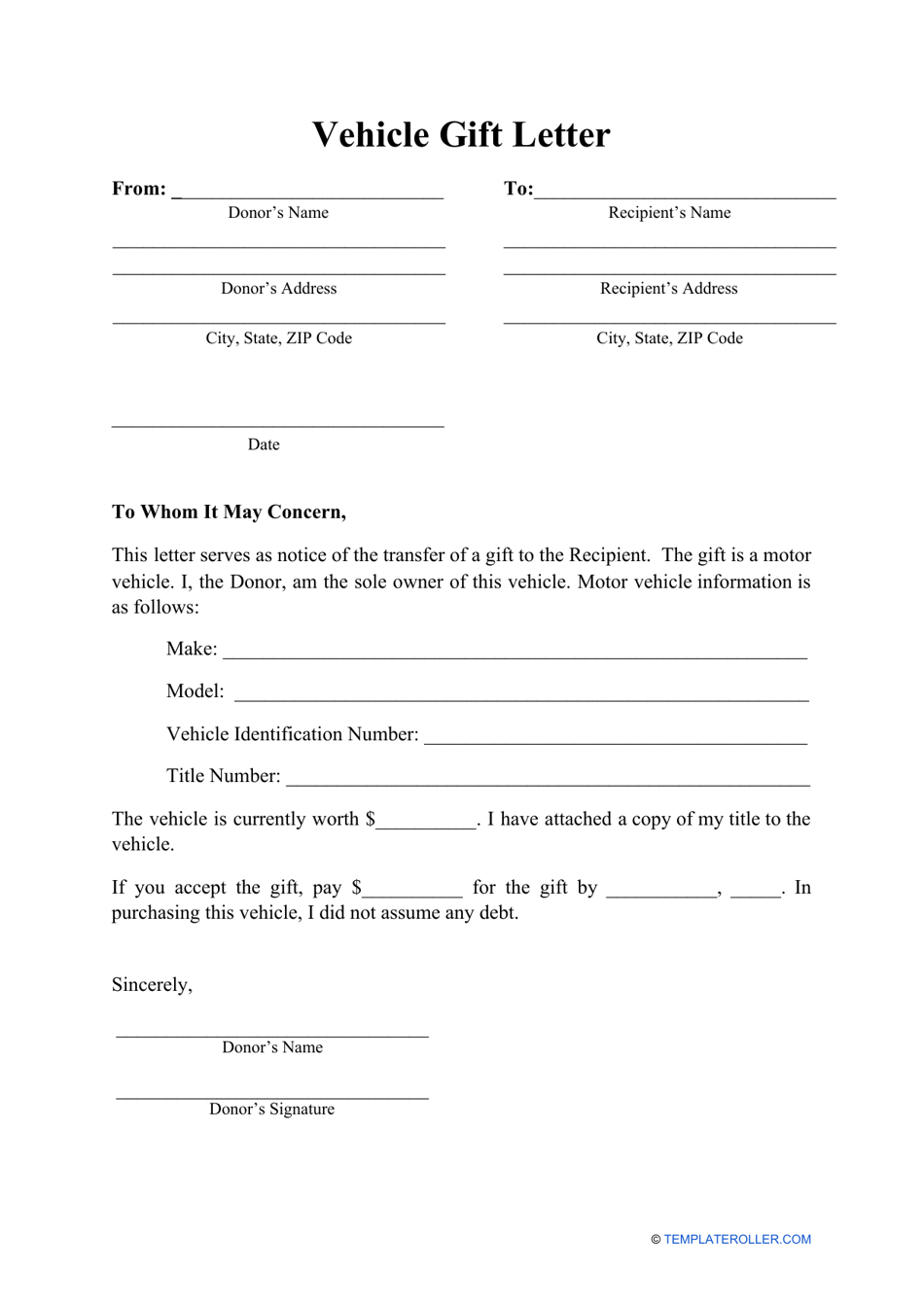

If you have decided to gift your vehicle to a family member or friend, it is important to provide them with a vehicle gift letter. This document serves as proof of ownership transfer and protects both parties from any legal issues that may arise in the future. However, writing a vehicle gift letter can be a daunting task, especially if you have never done it before. In this article, we will guide you through the process of writing a clear and concise vehicle gift letter that covers all the necessary details.

- Begin the letter by including the date, your full name, and address.

- Next, include the recipient’s full name and address.

- State that you are gifting the vehicle to the recipient.

- Include the vehicle’s make, model, year, and VIN number.

- Specify that the gift is being given without any exchange of money.

- Conclude the letter with your signature and contact information.

How to Write a Vehicle Gift Letter?

A vehicle gift letter is a legal document that records the transfer of ownership of a vehicle from one person to another as a gift. If you’re planning to give someone a car, truck or any other vehicle, it’s important to prepare a gift letter that documents the transaction. Here are the steps to follow when writing a vehicle gift letter.

1. Include the Basic Information

The first step in writing a vehicle gift letter is to include the basic information about the involved parties. This should include the full names and addresses of both the giver and the receiver of the vehicle. You should also include the make, model, and year of the vehicle being gifted.

It’s important to ensure that all the information provided is accurate and up-to-date. This will help to prevent any legal issues that may arise in the future.

2. Explain the Purpose of the Letter

The next step is to explain the purpose of the letter. You should clearly state that the vehicle is being gifted to the receiver and that there is no exchange of money involved in the transaction. This will help to prevent any confusion or misunderstandings about the nature of the gift.

It’s important to note that a vehicle gift letter is a legal document and should be treated as such. You should take the time to ensure that the language used is clear and concise.

3. Provide the Vehicle Information

The next step is to provide detailed information about the vehicle being gifted. This should include the make, model, year, VIN number, and any other relevant details. You should also include the current mileage of the vehicle.

Including this information will help to ensure that the transfer of ownership is recorded accurately and that there are no disputes about the condition of the vehicle at the time of the transfer.

4. Sign and Date the Letter

Once you have provided all the necessary information, you should sign and date the letter. Both the giver and the receiver of the vehicle should sign the letter to indicate their agreement to the terms of the gift.

It’s important to ensure that the signatures are legible and that the date is clearly indicated. This will help to prevent any disputes about the timing of the transfer of ownership.

5. Include a Witness Signature

While not strictly necessary, it’s often a good idea to include a witness signature on the vehicle gift letter. This can be a friend, family member, or even a notary public.

The witness signature will help to provide additional legal weight to the document and can be useful in the event of any disputes that may arise in the future.

6. Keep a Copy of the Letter

Once the letter has been signed and dated, it’s important to keep a copy for your records. This will help to ensure that you have a record of the transfer of ownership and can be useful in the event of any legal issues that may arise in the future.

You should also consider providing a copy of the letter to the receiver of the vehicle as proof of ownership.

7. Benefits of Writing a Vehicle Gift Letter

There are several benefits to writing a vehicle gift letter. Firstly, it provides a clear record of the transfer of ownership and can help to prevent any disputes that may arise in the future. Secondly, it can be used as proof of ownership for insurance and registration purposes.

Finally, it can help to demonstrate your goodwill towards the receiver of the vehicle and can be a great way to show your appreciation for their friendship or support.

8. Vehicle Gift Letter vs Bill of Sale

While a vehicle gift letter and a bill of sale may seem similar, there are some key differences between the two documents. A bill of sale is a legal document that records the sale of a vehicle from one person to another in exchange for money.

A vehicle gift letter, on the other hand, is used to record the transfer of ownership of a vehicle from one person to another as a gift. While both documents are important, it’s important to ensure that you use the correct document for your transaction.

9. Tips for Writing a Vehicle Gift Letter

When writing a vehicle gift letter, there are several tips you should keep in mind. Firstly, ensure that all the information provided is accurate and up-to-date. This will help to prevent any legal issues that may arise in the future.

Secondly, use clear and concise language to ensure that the purpose of the gift letter is clearly understood. Finally, make sure that both parties sign and date the letter to indicate their agreement to the terms of the gift.

10. Conclusion

In conclusion, a vehicle gift letter is an important legal document that should be prepared whenever a vehicle is being gifted from one person to another. By following the steps outlined in this article, you can ensure that the transfer of ownership is recorded accurately and that there are no disputes about the nature of the gift.

Remember to keep a copy of the letter for your records and to provide a copy to the receiver of the vehicle as proof of ownership. With these tips in mind, you can confidently give the gift of a vehicle to someone special in your life.

Contents

Frequently Asked Questions:

Here are some commonly asked questions about how to write a vehicle gift letter:

What is a vehicle gift letter?

A vehicle gift letter is a document that is used to transfer ownership of a vehicle from one person to another, without any exchange of money. This letter is required by the DMV (Department of Motor Vehicles) when transferring the ownership of a vehicle as a gift or donation.

The gift letter must contain specific information about the donor, the recipient, and the vehicle being gifted. It is important to ensure that the letter is accurate and complete to avoid any legal issues in the future.

What information should be included in a vehicle gift letter?

The vehicle gift letter must include the name and contact information of both the donor and the recipient, as well as the make, model, and year of the vehicle being gifted. The letter must also state that the vehicle is being given as a gift, and that there is no exchange of money involved.

Additionally, the letter must include the date of the gift, the odometer reading at the time of the gift, and the signature of both the donor and the recipient. It is important to ensure that all information is accurate and complete to avoid any legal issues in the future.

Do I need to have the vehicle appraised before gifting it?

No, there is no need to have the vehicle appraised before gifting it. However, it is important to ensure that the value of the vehicle is accurately reported in the gift letter. If the value of the vehicle is not accurately reported, it may cause issues with taxes or other legal matters in the future.

If you are unsure of the value of the vehicle, you can use resources such as Kelley Blue Book or NADA Guides to help determine its value.

Can I use a template for a vehicle gift letter?

Yes, you can use a template for a vehicle gift letter. However, it is important to ensure that the template includes all necessary information, and that it is accurate and complete. Using an incomplete or inaccurate template may cause issues with transferring ownership of the vehicle or with taxes in the future.

If you are unsure of how to create a vehicle gift letter, you can consult with a legal professional or use a reputable template from a trusted source.

Do I need to notify the DMV when gifting a vehicle?

Yes, you need to notify the DMV (Department of Motor Vehicles) when gifting a vehicle. The DMV requires that you submit the vehicle gift letter along with the vehicle’s title and any other necessary documentation to transfer ownership of the vehicle.

It is important to ensure that you follow all necessary steps and provide all required documentation to the DMV to avoid any legal issues in the future.

In conclusion, writing a vehicle gift letter is a crucial step when gifting a car to a family member or friend. This letter serves as proof of the transfer of ownership and protects both parties involved.

When writing a gift letter, it’s important to include all necessary information such as the make and model of the vehicle, the VIN number, and the date of the transfer. Be sure to sign and notarize the letter to make it legally binding.

While it may seem like a hassle to write a gift letter, it’s essential to ensure a smooth transfer of ownership and avoid any legal issues in the future. By following these simple steps, you can confidently gift a car to your loved one and enjoy the peace of mind that comes with proper documentation.

Rakibul Hasan, the CEO and founder of Autosdonation, is an automotive specialist with over a decade of industry experience. With a distinct mastery in car donations, sponsorships, and gifting, Rakibul combines his passion for automobiles and generosity to revolutionize the car donation landscape. He established Autosdonation to facilitate the car donation and gifting process, making it more accessible and enjoyable for all involved.

More Posts