Rakibul Hasan, the CEO and founder of Autosdonation, is an automotive specialist with over a decade of industry experience. With a distinct mastery in car...Read more

Are you planning to gift a car to someone special and wondering what to write in the paper? Worry no more! This guide will provide you with all the necessary information to make your gift complete.

When gifting a car, it is important to have a written record of the transfer of ownership. This document, commonly known as a bill of sale, should include the vehicle information, names and addresses of both the buyer and the seller, and the sale price. Additionally, you may want to include a heartfelt message to the recipient to make the gift even more special. Keep reading for more tips on what to write in the paper when gifting a car.

Contents

- What to Write in Paper When Gifting a Car?

- Frequently Asked Questions

- What should be included in a bill of sale?

- Do I need to include a statement of gift?

- What information should be included in the car’s title and registration documents?

- Does the recipient need to have insurance before taking possession of the car?

- Are there any tax implications for gifting a car?

- How To Gift A Vehicle To Someone Without Paying Taxes

What to Write in Paper When Gifting a Car?

Giving a car as a gift is an incredibly generous gesture. However, with great generosity comes great responsibility. When gifting a car, there are a variety of legal and financial considerations to keep in mind. In this article, we’ll take a closer look at what to write in paper when gifting a car, so you can ensure a smooth and hassle-free transfer of ownership.

1. Bill of Sale

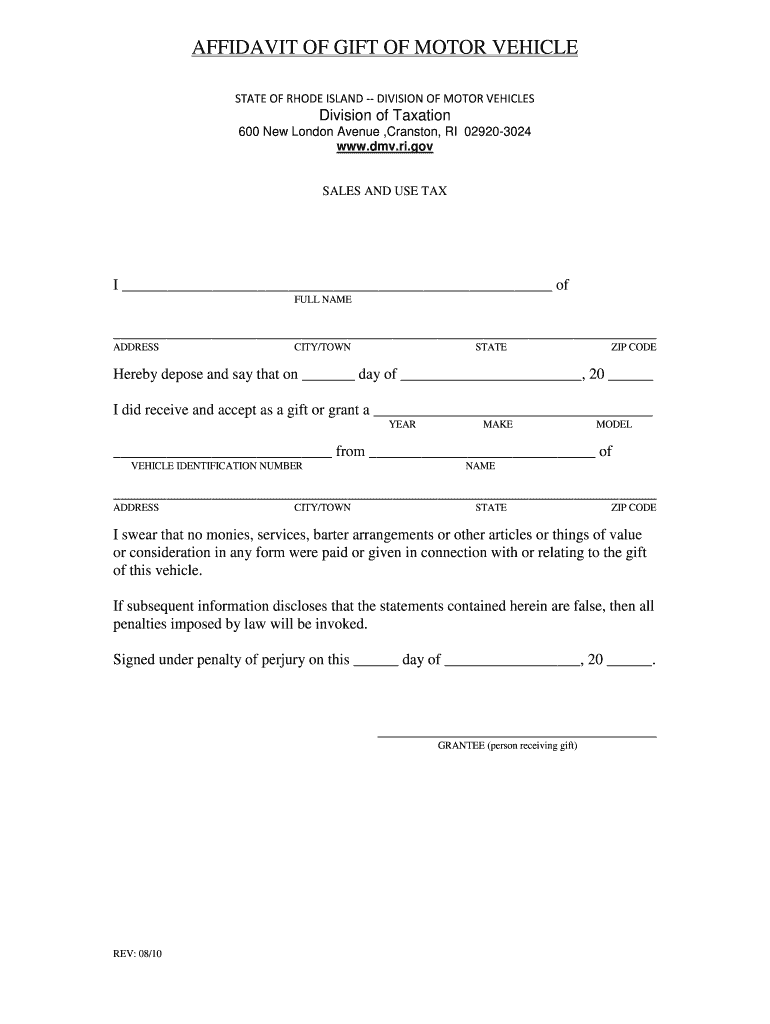

The first and most important document to complete when gifting a car is the bill of sale. This document contains all the important information about the transfer of ownership, including the names and addresses of both the buyer and the seller, the date of the sale, and the purchase price. Additionally, it’s important to include a statement that the vehicle is being gifted, and that no money has exchanged hands. This will protect both the buyer and the seller in case of any disputes down the line.

It’s also a good idea to include a section for the buyer to acknowledge that they have received the car as a gift, and that they understand and accept the terms of the transfer of ownership.

2. Title Transfer

Once the bill of sale is complete, the next step is to transfer the title of the car to the new owner. This is typically done at the local department of motor vehicles (DMV). The process may vary slightly depending on your location, but in general, the new owner will need to provide proof of insurance and pay any applicable transfer fees.

It’s important to note that the original owner will need to sign the title over to the new owner. This is typically done in the presence of a notary public, who will verify the identity of both parties and witness the signing of the document.

3. Gift Tax

One potential downside of gifting a car is the gift tax that may be incurred. The IRS considers any gift over a certain value to be taxable income, and the recipient may be responsible for paying taxes on the gift.

Fortunately, there are a few ways to avoid or minimize gift tax. One option is to simply keep the value of the car below the annual gift tax exclusion limit. As of 2021, this limit is $15,000 per recipient. Another option is to use the lifetime gift tax exemption, which allows you to gift up to a certain amount over your lifetime without incurring gift tax.

4. Insurance

Before driving away in their new car, the new owner will need to make sure they have adequate insurance coverage. In some cases, the new owner can simply add the car to their existing policy. However, if the new owner is a young driver or has a poor driving record, they may need to purchase their own insurance policy.

It’s important to note that the insurance policy should be in the name of the new owner, not the gift giver. Additionally, if the car is being financed, the lender may require certain levels of insurance coverage.

5. Registration

In addition to transferring the title of the car, the new owner will also need to register the vehicle in their name. This is typically done at the DMV, and will require the new owner to provide proof of insurance and pay any applicable registration fees.

It’s important to note that the registration should be in the name of the new owner, not the gift giver. Additionally, if the car is being financed, the lender may require certain levels of registration and licensing.

6. Maintenance and Repairs

Once the car has been gifted, the new owner is responsible for all maintenance and repairs. It’s important to make sure the new owner is aware of any ongoing issues with the car, such as mechanical problems or necessary repairs, before gifting the car.

Additionally, it’s a good idea to provide the new owner with any maintenance records or receipts for work that has been done on the car. This will help the new owner keep track of any necessary maintenance and repairs.

7. Liens and Loans

If the car has an outstanding lien or loan, it’s important to pay off the remaining balance before gifting the car. This will ensure that the new owner has clear title to the vehicle, and won’t be responsible for any outstanding debts.

If you’re unable to pay off the lien or loan in full, you may be able to transfer the debt to the new owner. However, this can be a complicated process, and may require the involvement of a lawyer or financial advisor.

8. Vehicle History

Before gifting a car, it’s important to provide the new owner with a complete vehicle history report. This report will contain information about any accidents or incidents the car has been involved in, as well as any previous owners and service records.

Providing the new owner with a complete vehicle history report will help them make informed decisions about the car’s maintenance and repairs, and can also help them avoid potential issues with the car in the future.

9. Benefits of Gifting a Car

While there are certainly some legal and financial considerations to keep in mind when gifting a car, there are also a number of benefits to this generous gesture. Gifting a car can be a wonderful way to show someone how much you care, and can also help them achieve greater financial independence and mobility.

In addition, gifting a car can also help reduce your own tax liability, particularly if you’re looking to reduce the size of your estate. By gifting assets like a car, you can help ensure that your loved ones receive the maximum benefit from your estate.

10. Gifting a Car vs. Selling a Car

Finally, it’s worth considering the pros and cons of gifting a car versus selling it. While gifting a car can be a wonderful way to show someone you care, it can also be a significant financial and legal commitment.

Selling a car, on the other hand, can be a more straightforward process, and can help you recoup some or all of the value of the car. However, this process can also be more time-consuming and may require more paperwork and legal documentation.

Ultimately, the decision to gift or sell a car will depend on your individual circumstances and priorities. However, by keeping these considerations in mind, you can ensure that the process goes as smoothly and efficiently as possible.

Frequently Asked Questions

When gifting a car, it’s important to include a written statement that officially transfers ownership to the recipient. This statement should be included in the car’s title and registration documents, as well as a separate bill of sale. Here are some common questions and answers about what to write in paper when gifting a car.

What should be included in a bill of sale?

A bill of sale is a written document that officially transfers ownership of a car from one person to another. When gifting a car, the bill of sale should include the names and addresses of both the giver and the recipient, as well as the date of the transfer and the car’s make, model, and VIN number. It should also state that the transfer is a gift, with no money exchanged.

Both parties should sign and date the bill of sale, and each should keep a copy for their records. It’s also a good idea to have the bill of sale notarized to add an extra layer of legal protection.

Do I need to include a statement of gift?

Yes, a statement of gift is an important document to include when gifting a car. This document should be included with the car’s title and registration documents, and it should state that the car is a gift from the giver to the recipient, with no money exchanged. The statement should also include the names and addresses of both parties, as well as the date of the transfer.

It’s important to have a statement of gift to avoid any confusion or disputes about the transfer of ownership. Without this document, the recipient may be responsible for paying taxes on the car as if it were a purchase, even if no money was exchanged.

What information should be included in the car’s title and registration documents?

When gifting a car, the title and registration documents should be updated to reflect the transfer of ownership. The recipient will need to register the car in their own name and obtain a new title. The title should include the names and addresses of both the giver and the recipient, as well as the date of the transfer and the car’s make, model, and VIN number.

Both parties should sign and date the title, and the recipient should take it to the DMV to complete the transfer of ownership. It’s important to follow the DMV’s specific instructions for transferring ownership in your state.

Does the recipient need to have insurance before taking possession of the car?

Yes, it’s important for the recipient to have insurance before taking possession of the car. The giver should not cancel their insurance until the transfer of ownership is complete and the recipient has obtained their own insurance.

The recipient should contact their insurance company to add the car to their policy before taking possession of it. This will ensure that they are covered in case of an accident or other incident.

Are there any tax implications for gifting a car?

Yes, there may be tax implications for gifting a car, depending on the state where the transfer takes place. Some states require the recipient to pay a gift tax or sales tax on the value of the car, even if no money was exchanged.

It’s important to check the specific tax laws in your state and to include a statement of gift to help avoid any confusion or disputes about the transfer of ownership.

How To Gift A Vehicle To Someone Without Paying Taxes

In conclusion, gifting a car can be an exciting and generous gesture, but it’s important to make sure you have all the necessary paperwork in order. When writing in the paper, it’s essential to include the date of the gift, the make and model of the car, and the VIN number. Additionally, be sure to include any specific terms or conditions of the gift, such as whether the recipient is responsible for paying taxes or registration fees.

Remember to also consider the insurance and registration of the vehicle. It’s crucial to have the proper insurance coverage before the recipient takes possession of the car. The registration must also be transferred to the new owner’s name to avoid any legal issues down the line.

Lastly, take the time to personalize the gift by including a heartfelt note or a small present, such as a car cleaning kit or air fresheners. This will not only make the gift more meaningful but will also show the recipient how much you care. By following these simple steps, you can ensure a smooth and enjoyable gifting process for both you and the recipient.

Rakibul Hasan, the CEO and founder of Autosdonation, is an automotive specialist with over a decade of industry experience. With a distinct mastery in car donations, sponsorships, and gifting, Rakibul combines his passion for automobiles and generosity to revolutionize the car donation landscape. He established Autosdonation to facilitate the car donation and gifting process, making it more accessible and enjoyable for all involved.

More Posts