Rakibul Hasan, the CEO and founder of Autosdonation, is an automotive specialist with over a decade of industry experience. With a distinct mastery in car...Read more

Are you considering gifting a car to your loved ones in Louisiana? You might be wondering if there are any restrictions on how many times you can gift a car in this state. Well, you’re in the right place! In this article, we’ll explore the rules and regulations surrounding gifting cars in Louisiana, so you can make informed decisions and avoid any legal issues.

Gifting a car can be an act of kindness and generosity, but it’s important to know the legal requirements before you do so. In Louisiana, there are specific laws that govern car gifting, including limitations on how many times a car can be gifted. So, let’s dive in and discover everything you need to know about gifting a car in Louisiana.

How Many Times Can You Gift a Car in Louisiana?

If you live in Louisiana and are considering gifting a car to a friend or family member, you may be wondering how many times you can do this. In Louisiana, there are specific laws and regulations that govern the process of gifting a vehicle. In this article, we will explore these laws and answer the question of how many times you can gift a car in Louisiana.

What Is a Car Gift Transfer?

Before we dive into the specifics of car gifting in Louisiana, let’s first define what a car gift transfer is. A car gift transfer is when the title of a vehicle is transferred from one person to another as a gift, without any money exchanging hands between the two parties. This is different from selling a car, where the buyer pays the seller for the vehicle.

Transferring a Vehicle as a Gift in Louisiana

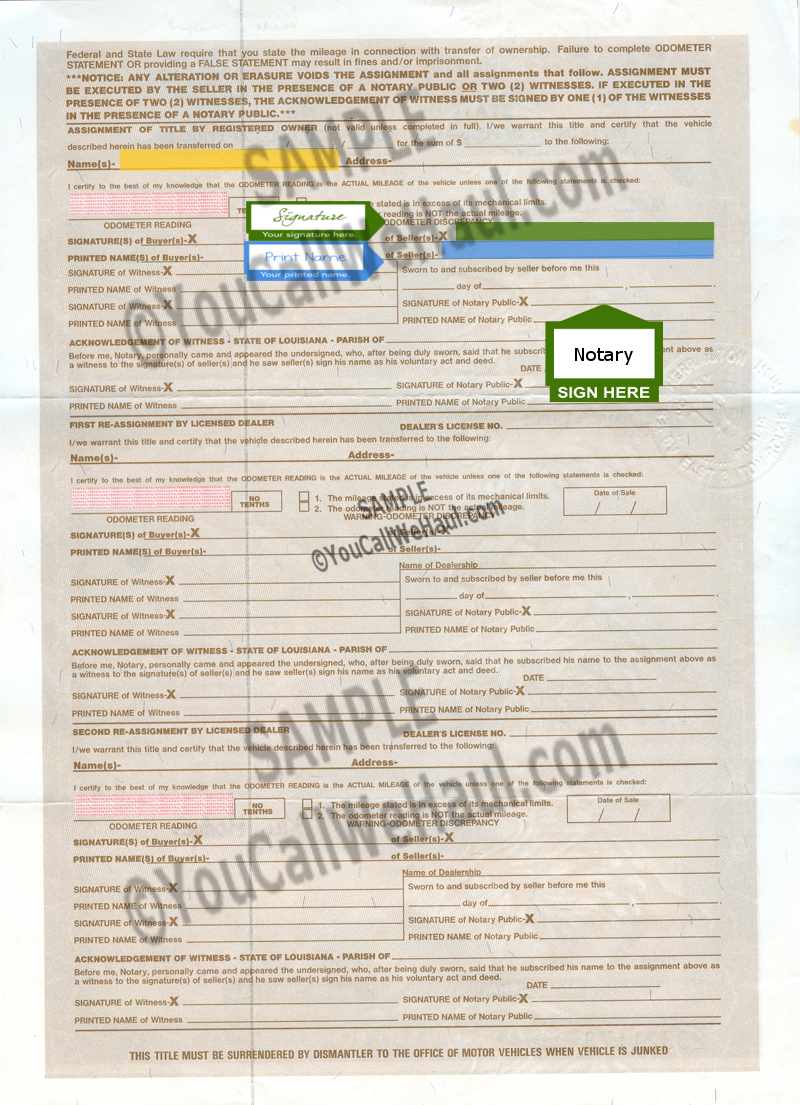

In Louisiana, the process of transferring a vehicle as a gift is relatively straightforward. The person giving the vehicle must sign the title over to the person receiving the vehicle, and the recipient must then take the title to the Louisiana Office of Motor Vehicles (OMV) to have it transferred into their name. The recipient will also need to provide proof of insurance and pay any necessary fees.

It is important to note that the person giving the vehicle will be responsible for paying any applicable gift tax. In Louisiana, the gift tax is based on the fair market value of the vehicle and is calculated at a rate of 4%.

How Many Times Can You Gift a Car in Louisiana?

There is no limit to the number of times you can gift a car in Louisiana. However, it is important to keep in mind that the gift tax will apply each time a vehicle is gifted. If you are gifting multiple vehicles, the gift tax will be calculated based on the fair market value of each vehicle.

It is also important to note that if you are gifting a vehicle to a family member, you may be eligible for an exemption from the gift tax. The Louisiana OMV provides an exemption for gifts between spouses, parents and children, and grandparents and grandchildren.

The Benefits of Gifting a Car in Louisiana

There are several benefits to gifting a car in Louisiana. First and foremost, it is a great way to help out a friend or family member who may not have the means to purchase a vehicle on their own. Additionally, gifting a car can be a way to reduce your taxable estate, as the fair market value of the vehicle will be removed from your estate.

Buying vs. Gifting a Car in Louisiana

While buying a car may seem like the more straightforward option, gifting a car can be a great alternative in certain situations. For example, if you have a vehicle that you no longer need and a friend or family member who could use it, gifting the car can be a win-win situation for both parties.

Additionally, gifting a car can be a more cost-effective option than buying a new vehicle. As the person gifting the car, you will not receive any money for the vehicle, but you will also not have to pay to dispose of it or to store it if you no longer need it.

The Bottom Line

In Louisiana, there is no limit to the number of times you can gift a car. However, it is important to keep in mind that the gift tax will apply each time a vehicle is gifted. If you are considering gifting a car in Louisiana, be sure to follow the proper procedures and consult with a tax professional to ensure that you are complying with all applicable laws and regulations.

Contents

- Frequently Asked Questions

- How Many Times Can You Gift a Car in Louisiana?

- What Do You Need to Gift a Car in Louisiana?

- Do You Have to Pay Taxes on a Gifted Car in Louisiana?

- Can You Gift a Car to Someone Out of State?

- What Happens if You Don’t Transfer a Car Title in Louisiana?

- How To Gift A Vehicle To Someone Without Paying Taxes

Frequently Asked Questions

How Many Times Can You Gift a Car in Louisiana?

In Louisiana, there is no limit to how many times you can gift a car. However, it is important to keep in mind that each time a car is gifted, the title must be transferred to the new owner. This means that the seller must sign over the title to the new owner and the new owner must apply for a new title in their name.

It is also important to note that if the car is gifted to a family member, there may be tax implications. In Louisiana, there is a gift tax on transfers of property over a certain value. If the car is valued over this amount, the new owner may be responsible for paying the gift tax.

What Do You Need to Gift a Car in Louisiana?

To gift a car in Louisiana, you will need to sign over the title to the new owner. This means that the seller must sign the back of the title, indicating that they are transferring ownership to the new owner. The new owner must then take the signed title to the Louisiana Office of Motor Vehicles to apply for a new title in their name.

In addition to the signed title, you may also need other documents depending on the circumstances of the gift. For example, if the car is gifted to a family member, you may need to provide documentation to prove your relationship to the new owner. It is best to contact the Louisiana Office of Motor Vehicles for specific requirements.

Do You Have to Pay Taxes on a Gifted Car in Louisiana?

In Louisiana, there is a gift tax on transfers of property over a certain value. If the car is valued over this amount, the new owner may be responsible for paying the gift tax. However, if the car is gifted to a family member, there may be exemptions or exclusions that apply.

For example, if the car is gifted to a spouse, there is no gift tax. If the car is gifted to a child, there is an exemption up to a certain value. It is best to consult with a tax professional or the Louisiana Department of Revenue for specific information about gift tax exemptions and exclusions.

Can You Gift a Car to Someone Out of State?

Yes, you can gift a car to someone out of state. However, the process for transferring ownership may be different depending on the state where the new owner lives. It is important to check with the state’s Department of Motor Vehicles to find out their specific requirements for transferring ownership of a gifted car.

In addition, if the car is being gifted to someone out of state, it may be necessary to transport the car to the new owner. This can be done by driving the car or by hiring a transport company to move the car. It is important to research transport options and costs before making a decision.

What Happens if You Don’t Transfer a Car Title in Louisiana?

If you don’t transfer a car title in Louisiana, the new owner will not be able to register the car or get a new title in their name. This can cause problems if the new owner is pulled over by law enforcement or if they need to sell the car in the future.

In addition, the seller may be held responsible for any accidents or other incidents that occur while the title is still in their name. This is why it is important to transfer the title to the new owner as soon as possible after the gift is made.

How To Gift A Vehicle To Someone Without Paying Taxes

In conclusion, while there is no limit to how many times you can gift a car in Louisiana, it’s important to keep in mind the potential tax implications and legal requirements involved. Whether you’re gifting a car to a family member, friend, or charitable organization, be sure to follow the proper procedures to ensure a smooth transfer of ownership.

Additionally, it’s always a good idea to consult with a qualified attorney or tax professional to ensure that you’re meeting all of the necessary legal and financial obligations. By taking these steps, you can help protect yourself and the recipient of the gift from any potential legal or financial issues down the road.

Overall, gifting a car can be a wonderful way to show someone you care, but it’s important to do so responsibly and with the proper guidance. By following the guidelines outlined in this article, you can ensure a successful and stress-free gift transfer process in Louisiana.

Rakibul Hasan, the CEO and founder of Autosdonation, is an automotive specialist with over a decade of industry experience. With a distinct mastery in car donations, sponsorships, and gifting, Rakibul combines his passion for automobiles and generosity to revolutionize the car donation landscape. He established Autosdonation to facilitate the car donation and gifting process, making it more accessible and enjoyable for all involved.

More Posts