Rakibul Hasan, the CEO and founder of Autosdonation, is an automotive specialist with over a decade of industry experience. With a distinct mastery in car...Read more

Are you planning to give a car as a gift to a loved one in Texas? Transferring the car title can be a bit tricky, but it’s essential to ensure that the new owner is legally recognized. In this guide, we’ll walk you through the steps on how to transfer a car title as a gift in Texas. From filling out the necessary paperwork to paying the required fees, we’ve got you covered. So, let’s get started!

- Fill out the title transfer section on the title certificate with the recipient’s information.

- Complete the Application for Texas Title and/or Registration form.

- Provide the gift tax affidavit if necessary.

- Submit the forms and fees to the county tax assessor-collector’s office within 30 days of the gift.

How to Transfer Car Title as a Gift in Texas?

If you are planning to gift your car to someone in Texas, then you need to transfer the car title properly. The process of transferring the car title as a gift in Texas is simple, but it requires you to follow certain steps. In this article, we will guide you through the process of transferring the car title as a gift in Texas.

Step 1: Know the Requirements

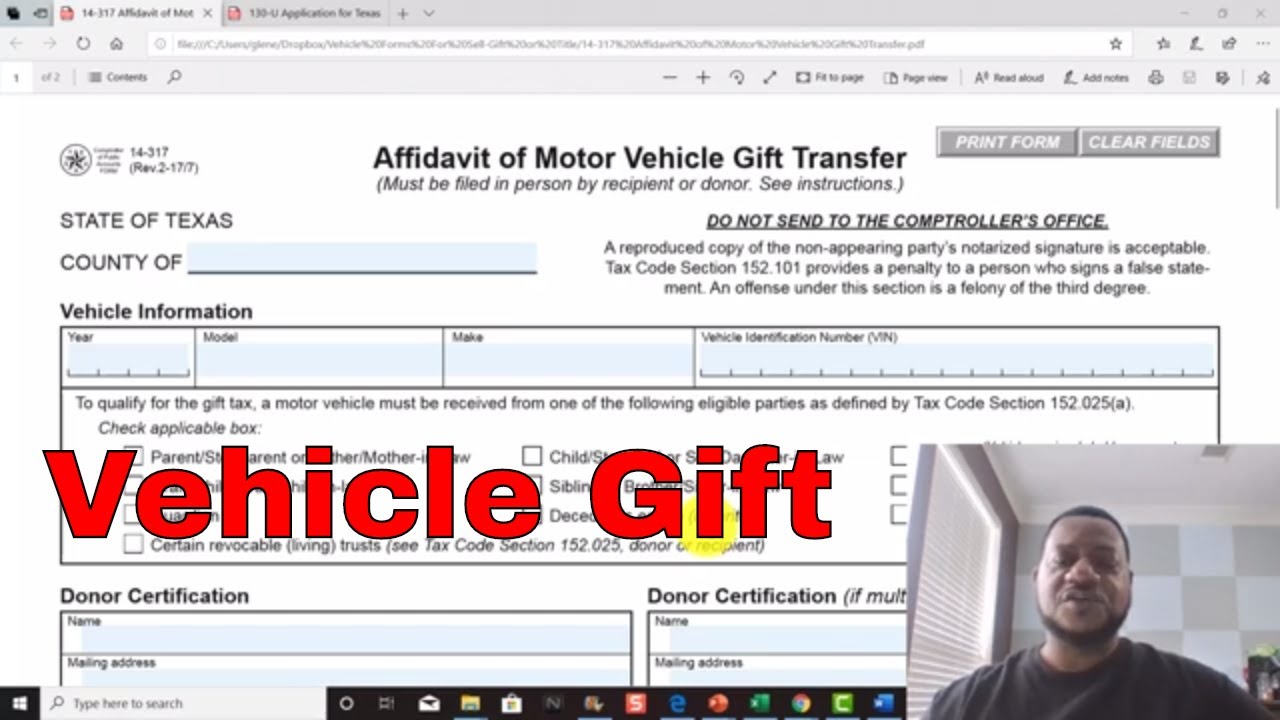

Before you transfer the car title as a gift in Texas, you need to know the requirements. You will need to fill out the forms for the transfer of ownership, such as the Application for Texas Certificate of Title (Form 130-U) and the Affidavit of Motor Vehicle Gift Transfer (Form 14-317). You will also need to provide proof of insurance and a valid ID.

To transfer the car title as a gift, you will need to provide a gift tax affidavit, which shows that no sales tax is due. The affidavit must be signed by both the donor and the recipient. You can download the affidavit from the Texas Department of Motor Vehicles (DMV) website.

Step 2: Fill Out the Forms

The next step is to fill out the required forms. You can download the forms from the Texas DMV website or get them from your local tax office. Make sure to fill out the forms accurately and completely. You will need to provide the car’s make, model, year, and VIN number.

Once you have filled out the forms, you need to sign them and have them notarized. You will also need to provide a copy of your valid ID and proof of insurance.

Step 3: Submit the Forms

After you have filled out the forms, you need to submit them to your local tax office along with the required fees. The fees for transferring the car title as a gift in Texas vary depending on the county. You can check the fees on the Texas DMV website.

Once you have submitted the forms and fees, the Texas DMV will process the transfer of ownership. The new owner will receive a new title and registration.

Benefits of Transferring Car Title as a Gift

Transferring the car title as a gift in Texas has several benefits. Firstly, it is a great way to show your loved ones that you care about them. Secondly, it is a cost-effective way to transfer ownership of a vehicle. Transferring the car title as a gift can save you money on sales tax.

Transferring Car Title as a Gift vs. Selling

Transferring the car title as a gift is different from selling a car. When you sell a car, you need to pay sales tax on the purchase price. However, when you transfer the car title as a gift, you do not need to pay sales tax. This can save you hundreds of dollars.

Transferring the car title as a gift is also a great way to avoid the hassle of selling a car. Selling a car can be time-consuming and stressful. However, transferring the car title as a gift is a simple process that can be done quickly and easily.

Conclusion

Transferring the car title as a gift in Texas is a great way to show your loved ones that you care about them. The process is simple, but it requires you to follow certain steps. You need to know the requirements, fill out the forms accurately, and submit them to your local tax office along with the required fees. By transferring the car title as a gift, you can save money on sales tax and avoid the hassle of selling a car.

Contents

- Frequently Asked Questions

- Q: Can I transfer my car title as a gift in Texas?

- Q: What documents do I need to transfer a car title as a gift in Texas?

- Q: Do I need to pay taxes when transferring a car title as a gift in Texas?

- Q: How long does it take to transfer a car title as a gift in Texas?

- Q: Can I transfer a car title as a gift if I am not a Texas resident?

- How To Gift A Vehicle To Someone Without Paying Taxes

Frequently Asked Questions

Q: Can I transfer my car title as a gift in Texas?

A: Yes, you can transfer your car title as a gift in Texas. However, there are certain requirements that you need to fulfill. First, the person to whom you are gifting the car must be a close family member, such as a spouse, child, sibling, or parent. Additionally, the car must have been in your possession for at least six months before the transfer.

Once you have met these requirements, you will need to fill out the necessary paperwork, including the Application for Texas Title and/or Registration (Form 130-U) and the Affidavit of Motor Vehicle Gift Transfer (Form 14-317). You will also need to pay any applicable fees, such as the title transfer fee.

Q: What documents do I need to transfer a car title as a gift in Texas?

A: To transfer a car title as a gift in Texas, you will need to fill out the Application for Texas Title and/or Registration (Form 130-U) and the Affidavit of Motor Vehicle Gift Transfer (Form 14-317). You will also need to provide a valid form of identification, such as a driver’s license, and proof of insurance.

In addition, you will need to provide the car’s current title, which should be signed and dated by the gift giver. If there is a lien on the vehicle, you will need to provide a lien release or a power of attorney from the lienholder.

Q: Do I need to pay taxes when transferring a car title as a gift in Texas?

A: Yes, you may need to pay taxes when transferring a car title as a gift in Texas. The amount of tax you will need to pay depends on the car’s value and whether or not the gift giver paid tax on the car when they acquired it. If the gift giver did not pay tax on the car, you will need to pay a gift tax based on the car’s current value.

If the gift giver did pay tax on the car, you will not need to pay tax again unless the car’s value has increased significantly since the gift giver acquired it. In this case, you will need to pay tax on the difference between the car’s current value and the value at the time the gift giver acquired it.

Q: How long does it take to transfer a car title as a gift in Texas?

A: The amount of time it takes to transfer a car title as a gift in Texas can vary depending on the specific circumstances of your situation. In general, it can take anywhere from a few days to several weeks to complete the transfer process.

To ensure that the process goes as smoothly and quickly as possible, make sure that you have all of the necessary documents and information ready before you begin. You can also expedite the process by submitting your paperwork online or in person at a local Texas Department of Motor Vehicles (DMV) office.

Q: Can I transfer a car title as a gift if I am not a Texas resident?

A: Yes, you can transfer a car title as a gift in Texas even if you are not a resident of the state. However, you will need to follow the same process as Texas residents and provide all of the necessary documentation and fees.

If you live out of state, you can submit your paperwork by mail to the Texas DMV. Alternatively, you can have a representative in Texas complete the transfer process on your behalf. Just make sure that you provide them with all of the necessary documents and information so that they can complete the transfer successfully.

How To Gift A Vehicle To Someone Without Paying Taxes

In conclusion, transferring a car title as a gift in Texas is a straightforward process that requires a few simple steps. As the giver, you must fill out the necessary forms and provide them to the recipient, who will then need to submit them to the Texas Department of Motor Vehicles. Once the transfer is complete, the recipient will officially be the new owner of the vehicle.

It’s important to remember that there are certain requirements that must be met in order to transfer a car title as a gift in Texas. Both the giver and the recipient must be Texas residents, and the vehicle must have a current Texas registration. Additionally, the recipient must have a valid driver’s license and proof of insurance.

Overall, transferring a car title as a gift in Texas can be a meaningful and generous gesture. By following the proper steps and meeting the necessary requirements, you can ensure a smooth and successful transfer that will allow the recipient to enjoy their new vehicle for years to come.

Rakibul Hasan, the CEO and founder of Autosdonation, is an automotive specialist with over a decade of industry experience. With a distinct mastery in car donations, sponsorships, and gifting, Rakibul combines his passion for automobiles and generosity to revolutionize the car donation landscape. He established Autosdonation to facilitate the car donation and gifting process, making it more accessible and enjoyable for all involved.

More Posts